Why Filing Your Workers’ Comp Claim Correctly Matters

If you’ve been hurt at work, filing a claim for work injury is your path to receiving medical care and replacing lost wages. Here’s what you need to know right away:

Quick Steps to File Your Claim:

- Report your injury to your supervisor immediately (within 30 days in California).

- Get medical treatment and tell providers it’s work-related.

- Complete the DWC-1 form your employer must give you within one working day.

- Return the form to your employer and keep a copy for yourself.

The workers’ compensation system helps you recover without worrying about fault. In California, employers must provide a claim form within one business day of learning about your injury and authorize up to $10,000 in medical treatment while your claim is reviewed.

Getting hurt at work is confusing. You’re dealing with pain, medical bills, and lost wages, all while navigating a complex legal process. The good news is that filing a claim doesn’t have to be overwhelming if you understand the steps and your rights. Most importantly, you cannot be fired or punished for filing a claim; California law protects you from retaliation.

This guide breaks down the process into simple steps so you can focus on your recovery.

Understanding Your Rights and Coverage

California’s workers’ compensation system is a no-fault safety net your employer is legally required to provide. It covers your medical care and lost wages if you get injured or sick because of your job. In return, your employer is protected from lawsuits.

The system works on a “no-fault” basis. This means it doesn’t matter who caused the accident; if your injury is work-related, you are entitled to benefits. Most employees in California are covered, including full-time, part-time, and temporary workers. Crucially, undocumented workers have the same rights to workers’ compensation as everyone else.

Your employer must carry workers’ comp insurance and provide a safe workplace. You have the right to file a confidential complaint with OSHA if you see hazards. You are also protected from retaliation. It is illegal for your employer to fire, demote, or punish you for filing a claim for work injury. If they do, under Labor Code section 132a, they can be ordered to reinstate you and pay lost wages.

What Injuries and Illnesses Are Covered?

Workers’ compensation covers more than just obvious accidents. The key is that the injury or illness must be work-related.

- Accidental injuries: These are single-incident events, like a slip and fall, a car accident while driving for work, or an injury from lifting a heavy object.

- Repetitive motion injuries: These develop over time from repeated movements, such as carpal tunnel syndrome from typing or hearing loss from a noisy work environment.

- Occupational diseases: These arise from exposure to harmful substances or conditions at work, like breathing problems from inhaling fumes or a skin condition from handling chemicals.

- Mental health injuries: Conditions like anxiety, depression, or PTSD caused by extreme job stress, harassment, or a traumatic event at work can also be covered.

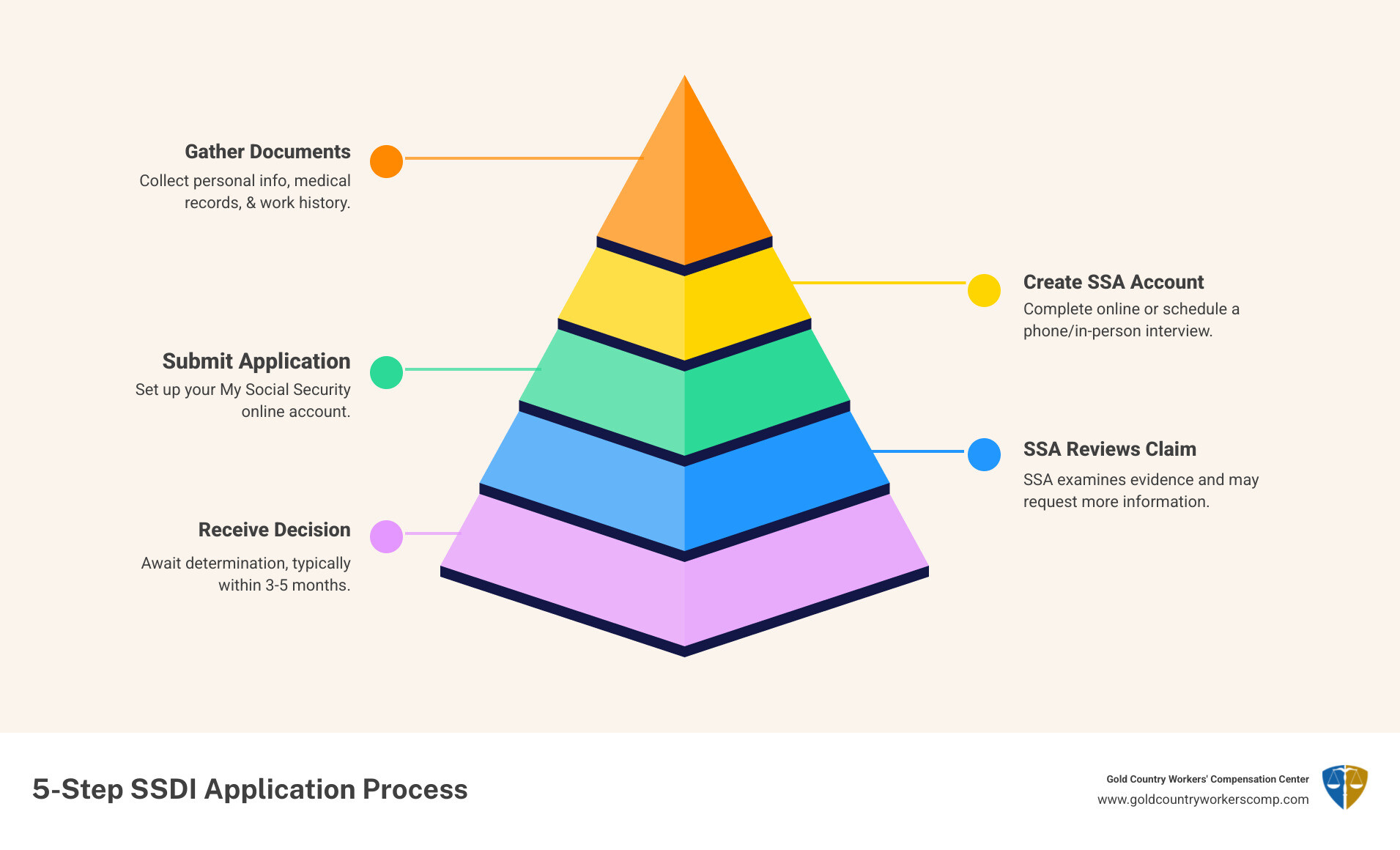

The Step-by-Step Process to File a Claim for Work Injury

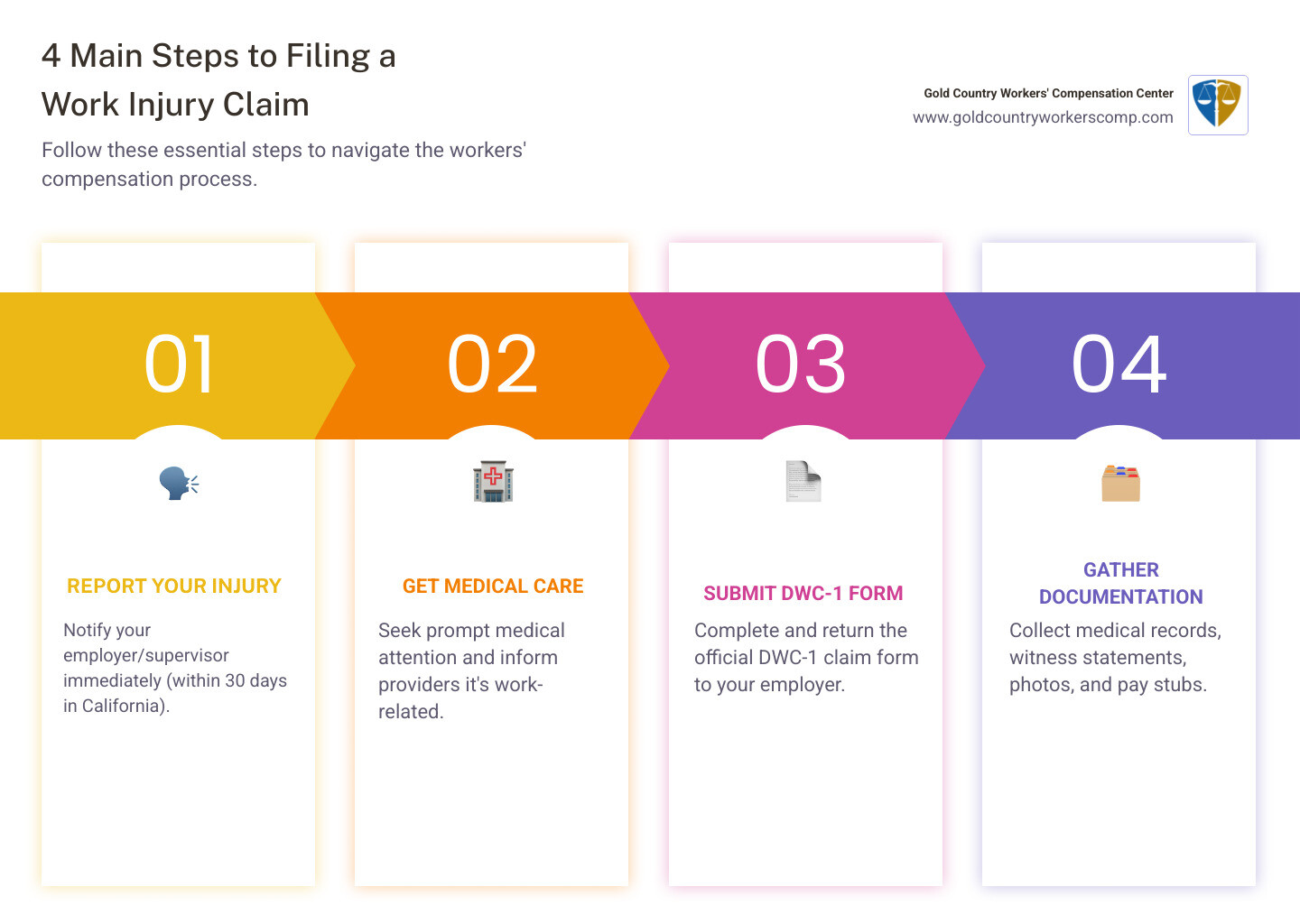

Now that you understand your rights, let’s walk through the four steps to file your claim for work injury.

Step 1: Report Your Injury to Your Employer

Tell your supervisor about your injury as soon as possible. While you have 30 days in California to report it, doing so immediately helps establish a clear timeline. Follow up any verbal report with a written one (like an email) and document who you spoke to and when. This creates a crucial paper trail.

Step 2: Get Prompt Medical Attention

Your health is the priority. For emergencies, go to the nearest ER or urgent care. For non-emergencies, you’ll likely see a doctor in your employer’s Medical Provider Network (MPN). In either case, tell all medical staff that your injury is work-related. This is vital for billing and documentation. You can also predesignate your personal doctor for work injuries by filing paperwork in advance.

While your claim is under review, your employer is required to authorize up to $10,000 in medical care, so you can get treatment without delay.

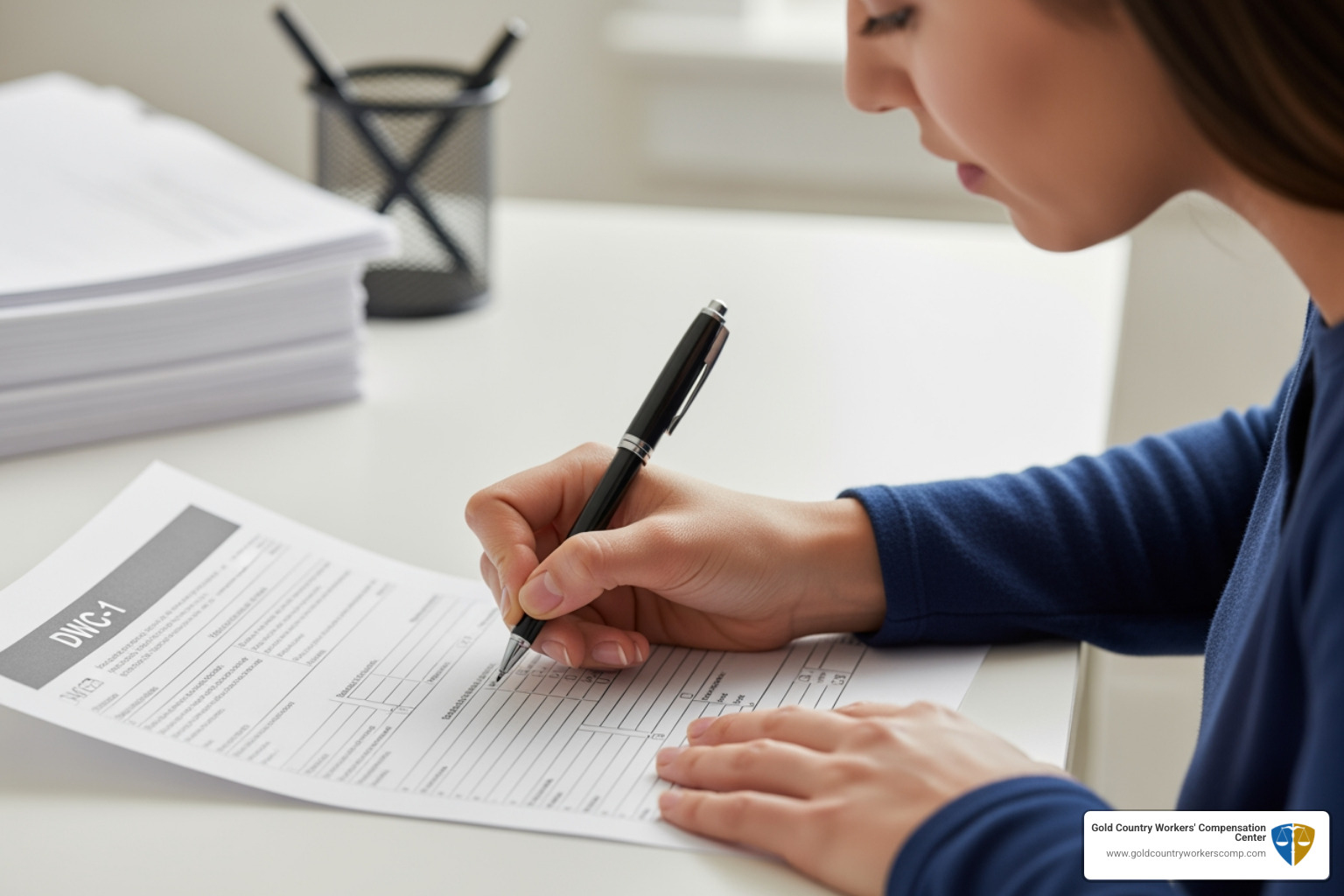

Step 3: Complete and Submit the Official Claim Form

This step officially starts your claim. Your employer must give you a DWC-1 claim form within one working day of learning about your injury. If they don’t, you can download it from the Division of Workers’ Compensation website.

Carefully fill out the ’employee’ section and return it to your employer. Consider sending it by certified mail for proof of delivery. Most importantly, make and keep a copy for your records.

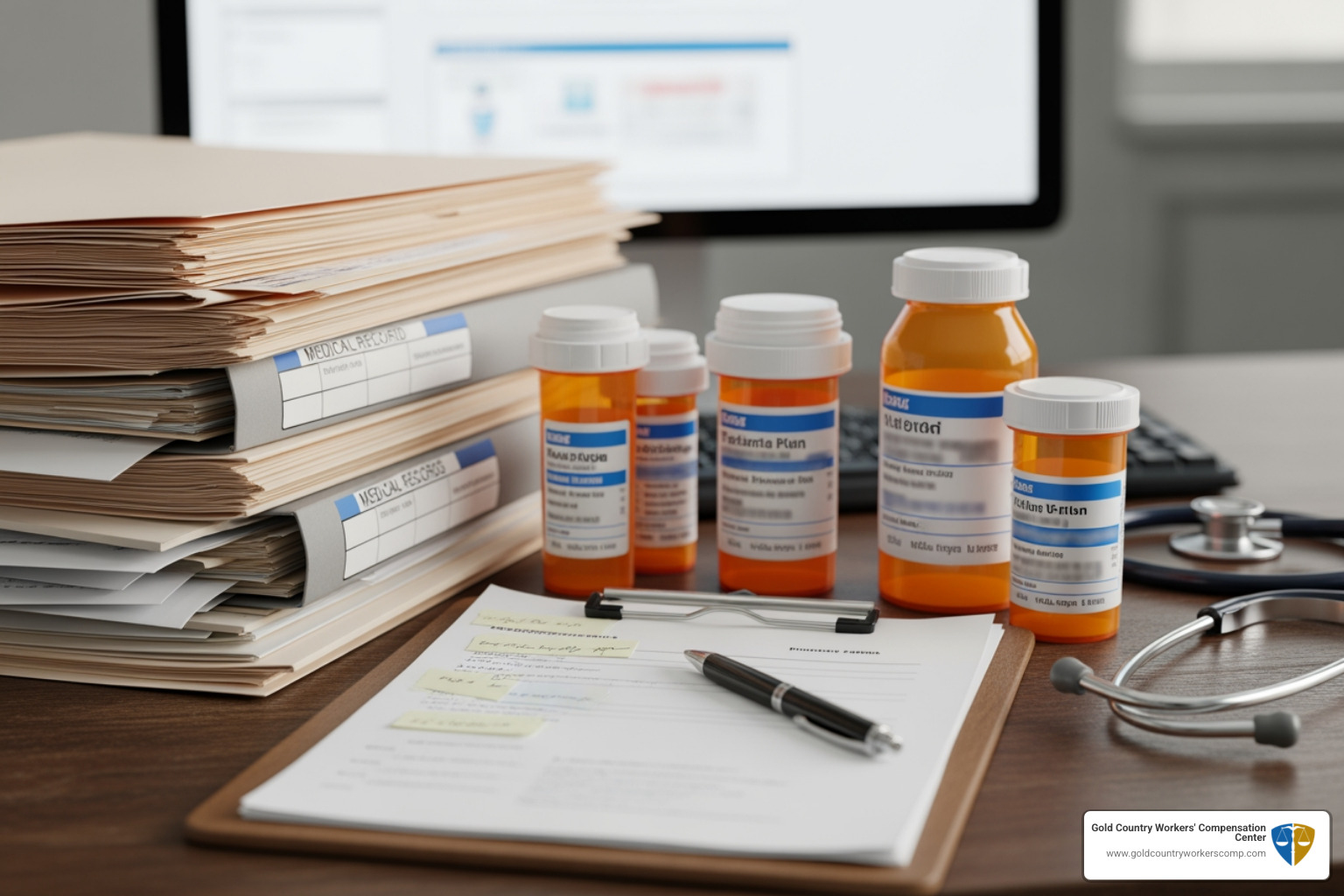

Step 4: Gather Key Documentation for Your Claim for Work Injury

Organized records will make your claim process smoother. Start a file and collect the following:

- Medical Records: Doctor’s notes, test results, prescriptions, and bills. Pay attention to notes on your work restrictions.

- Witness Information: Get contact details and a brief statement from anyone who saw the accident.

- Photos: If safe, photograph the accident scene, any hazards, or broken equipment.

- Pay Stubs: These are used to calculate your wage replacement benefits.

- Communications: Keep copies of all emails, letters, and notes from conversations with your employer about the injury.

What Happens After You File? The Claim Lifecycle

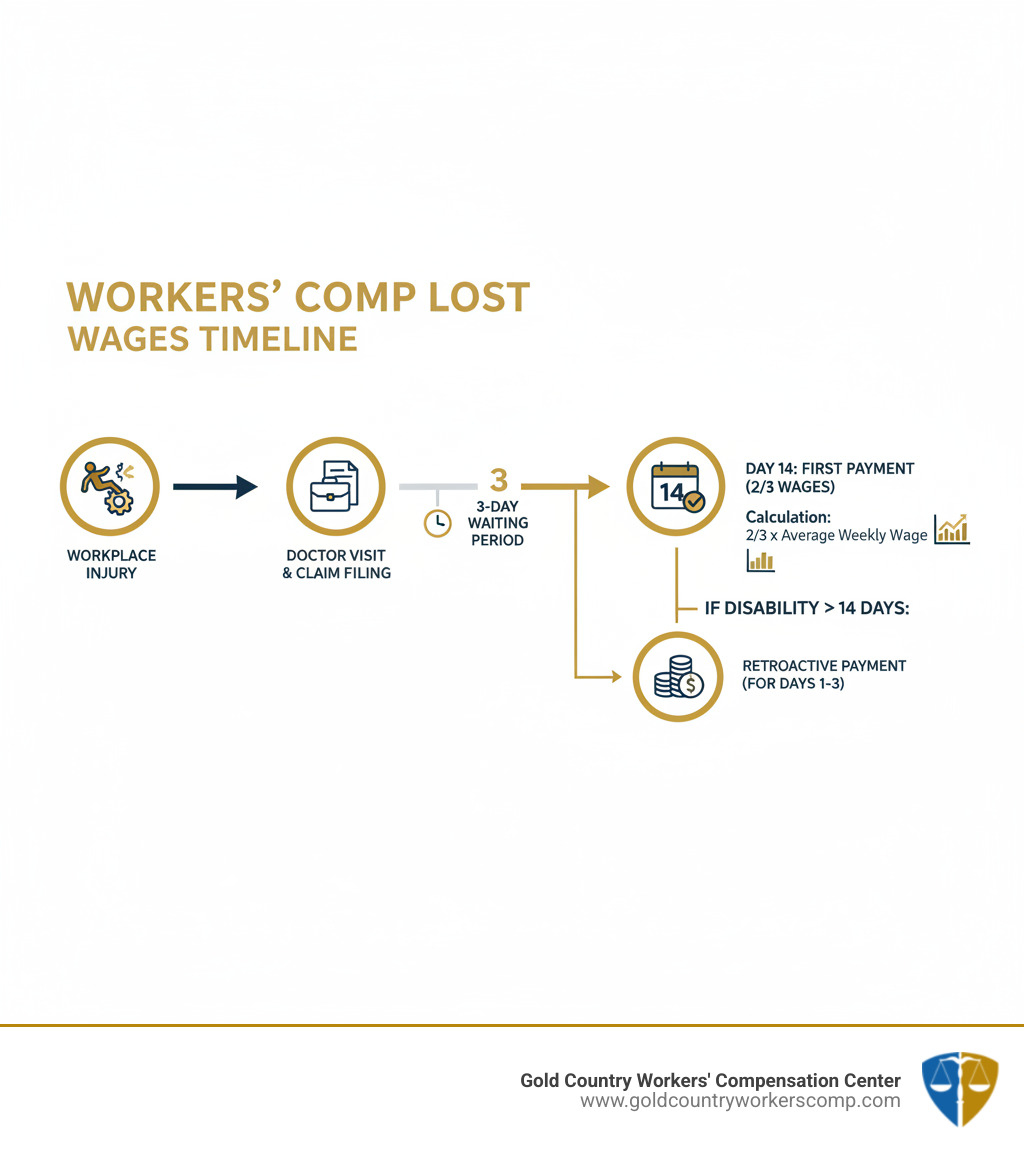

After you submit the DWC-1 form, a claims administrator from your employer’s insurance company will review your case. They have 14 days to send you a letter about your claim’s status (accepted, denied, or delayed for investigation).

Under California’s 90-day presumption rule, if the administrator doesn’t deny your claim within 90 days of receiving the form, your injury is presumed to be work-related. This shifts the burden of proof to them if they later decide to challenge it.

Understanding Your Workers’ Compensation Benefits

If your claim for work injury is approved, you are entitled to several benefits:

- Medical Care: Covers all reasonable and necessary treatment, including doctor visits, surgery, physical therapy, and prescriptions.

- Wage Replacement: Temporary or permanent disability benefits to compensate for lost income.

- Vocational Rehabilitation: A Supplemental Job Displacement Benefit (SJDB) voucher (up to $6,000) for retraining if you can’t return to your old job.

- Death Benefits: Financial support for dependents if a work injury is fatal.

Here is a quick comparison of the two types of disability benefits:

| Benefit Type | Description |

|---|---|

| Temporary Disability (TD) | Payments made while you are recovering and unable to work. They are roughly two-thirds of your average weekly wage, paid until you return to work or your condition stabilizes. |

| Permanent Disability (PD) | Payments made if your injury results in a lasting impairment that reduces your future earning capacity. The amount is based on a disability rating determined by a doctor. |

Your Responsibilities During the Claim Process

To ensure a smooth process, you must actively participate in your claim:

- Attend all medical appointments. This is crucial for your recovery and for documenting your injury.

- Cooperate with reasonable requests from the claims administrator.

- Immediately report any return to work or other earnings, as this affects your benefits. Failure to do so is considered fraud.

- Follow your doctor’s treatment plan and work restrictions.

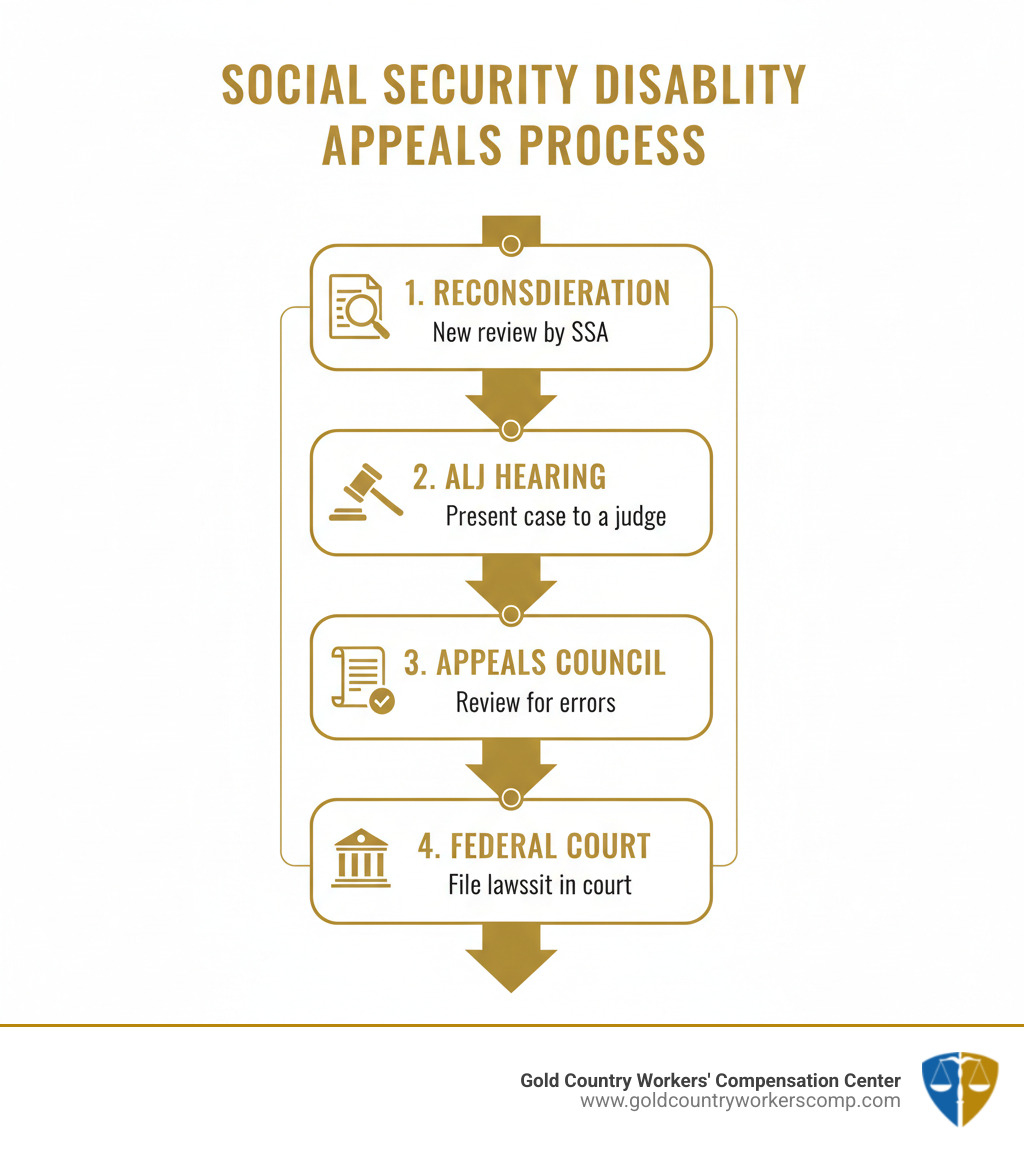

Navigating Challenges and Disputes

Sometimes, even when you do everything right, you may face challenges with your claim for work injury. A roadblock isn’t a dead end, and you have options.

What to Do if Your Claim for Work Injury is Denied

A denial letter is not the final word. Claims can be denied for many reasons, such as a belief the injury isn’t work-related or a lack of medical evidence. Your next step is to file an appeal with the Workers’ Compensation Appeals Board (WCAB), the court that handles these disputes.

Appeals have strict deadlines, and the process is formal. Missing a deadline can mean losing your right to challenge the denial. This is a critical stage where an experienced attorney can be invaluable.

If you believe your employer retaliated against you for filing, you can file a separate complaint. Learn more at How to File a Whistleblower Complaint.

Workers’ Compensation Fraud

Honesty is essential from all parties. Employee fraud, such as faking or exaggerating an injury to collect benefits, is a felony in California. Conviction can lead to fines up to $150,000 and five years in jail.

Employer fraud is also a serious crime. This includes underreporting payroll to lower insurance costs or illegally retaliating against workers who file claims. These actions are also felonies with significant fines and potential jail time. Fraud undermines the entire system, which is designed to protect genuinely injured workers.

Frequently Asked Questions about Work Injury Claims

We’ve helped injured workers in Nevada City, Grass Valley, and throughout California for nearly 50 years. Here are answers to some of the most common questions about filing a claim for work injury.

Can my employer fire me for filing a workers’ compensation claim?

No. It is illegal for an employer to fire, demote, or otherwise retaliate against you for filing a claim. California Labor Code section 132a specifically protects you. If an employer violates this law, they can be ordered to reinstate you and pay lost wages. If you believe you’ve been retaliated against, contact us immediately.

How does workers’ comp interact with other benefits like State Disability (SDI)?

If your workers’ comp claim is delayed or denied, you may be able to receive State Disability Insurance (SDI) benefits from the EDD. Think of SDI as a temporary bridge. If your workers’ comp claim is later approved, you will likely have to repay the SDI benefits you received to avoid duplicate payments. We can help you steer this coordination.

Do I need a lawyer to file a claim?

You can file a claim for work injury on your own, especially for simple, undisputed cases. However, the system is complex. An attorney becomes crucial if your claim is denied, your employer disputes the injury, or complications arise.

Your employer’s insurance company has a team of professionals working for them; having your own advocate levels the playing field. At Gold Country Workers’ Compensation Center, we offer early intervention with no initial consultation fee. With nearly 50 years of experience, we can provide professional guidance from the start, ensuring your rights are protected.

Secure the Benefits You Deserve

When you’re dealing with a work injury, acting quickly and following the correct procedures is critical to your claim for work injury. We understand that navigating this system while in pain is overwhelming, but you don’t have to do it alone.

At Gold Country Workers’ Compensation Center, we have spent nearly 50 years helping injured workers in Roseville, Nevada City, and throughout California get the benefits they deserve. We know the tactics insurers use and how to counter them.

Our approach is early intervention, and we offer it with no initial consultation fee. This means you get experienced legal guidance from the start without worrying about upfront costs. We handle the legal complexities so you can focus on your recovery.

Don’t let confusion or fear stop you from getting the help you need. The workers’ compensation system exists to protect you, and we exist to make sure it does.

Ready to talk? Get help from an experienced Nevada City workers’ comp attorney today. We’re here to fight for the benefits you’ve earned.