Understanding Your Rights When Injured at Work

Suing your employer for workers comp is generally not allowed in California due to the “exclusive remedy rule.” This rule limits most injured workers to the workers’ compensation system, which provides benefits regardless of fault. However, you can file a civil lawsuit against your employer in specific, narrow situations:

- Your employer intentionally injured you or committed assault.

- Your employer fraudulently concealed a workplace hazard that caused your injury.

- Your employer manufactured a defective product that injured you (dual capacity doctrine).

- Your employer doesn’t carry workers’ compensation insurance as required by law.

- A third party (not your employer or coworker) caused your injury.

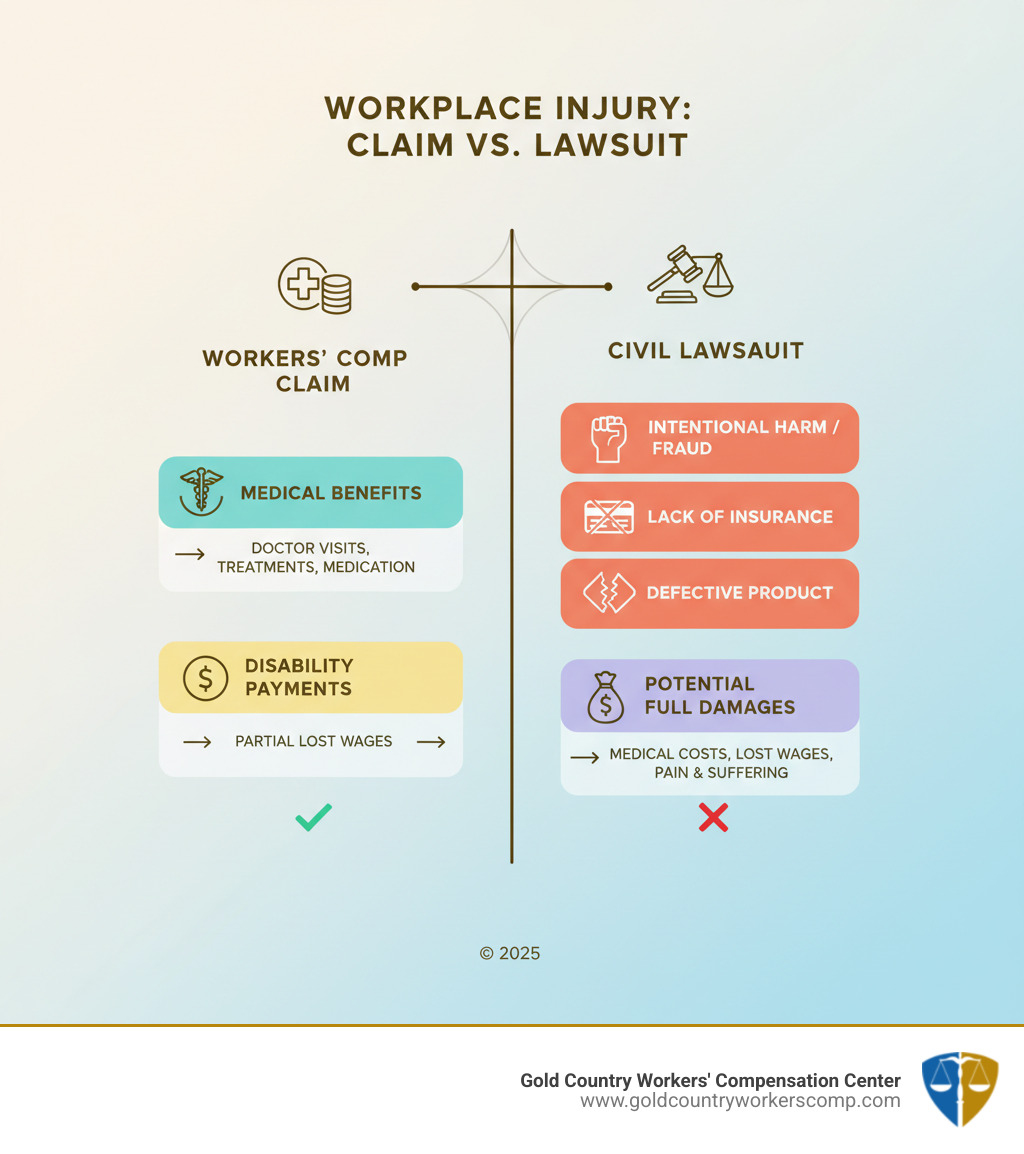

When you’re hurt on the job, it’s easy to feel overwhelmed by medical bills, lost wages, and a complex legal system. The workers’ comp system is designed to help, but it’s often a maze of forms and deadlines. Crucially, it does not allow you to sue for pain and suffering or recover your full lost wages.

Understanding the exceptions to the exclusive remedy rule is critical. The difference between a workers’ comp claim and a civil lawsuit is significant, affecting the compensation you can receive and what you need to prove. While workers’ comp offers guaranteed medical care and partial wage replacement, a lawsuit can provide far greater compensation but requires proving your employer’s intentional wrongdoing or that another exception applies.

Understanding the “Exclusive Remedy” Rule in California

When you get hurt at work in California, the “exclusive remedy” rule is the foundation of your case. It’s why suing your employer for workers comp is not an option in most cases.

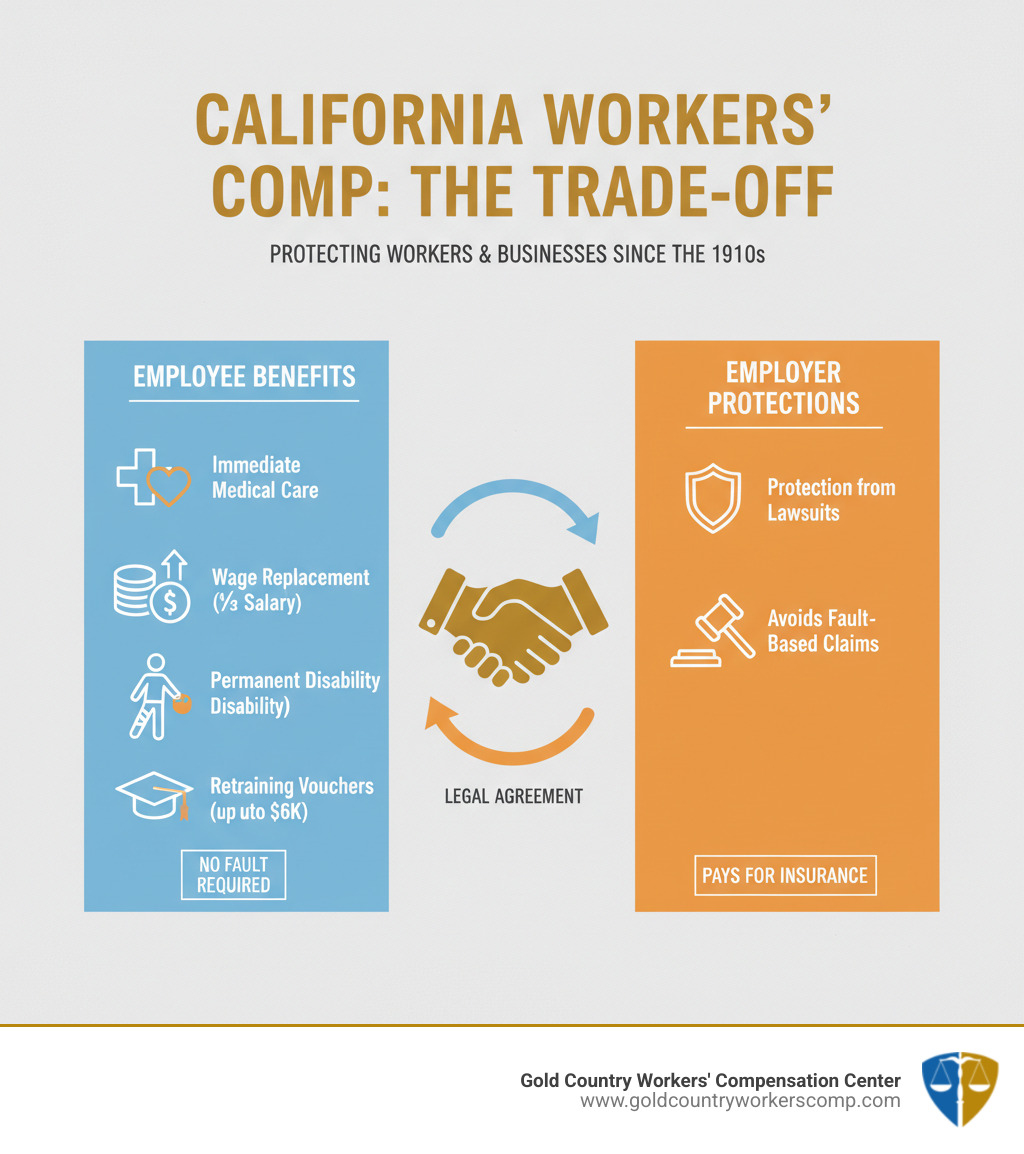

California’s workers’ compensation system is a trade-off. You receive guaranteed, no-fault benefits for medical treatment and lost wages. In exchange, your employer gets immunity from most lawsuits related to workplace injuries. This system provides a critical safety net, but the benefits are limited. You won’t receive compensation for pain and suffering, emotional distress, or punitive damages. Understanding these boundaries is essential. To learn more about how this system protects your rights, visit our page on California Workers Compensation Lawyer.

Can I sue my employer if they were just negligent?

This is a common question. If your employer was guilty of ordinary negligence—like failing to put out a warning sign for a wet floor—you generally cannot sue them. The exclusive remedy barrier applies even if their mistake led to your injury.

The line between ordinary negligence and gross negligence (a severe lack of care or reckless disregard for safety) can be blurry. Proving fault at this higher level is difficult and requires showing that your employer’s actions went far beyond simple carelessness. An experienced attorney can help determine if your case involves more than just ordinary negligence. For information on damages like pain and suffering, see our guide on Can Sue Pain Suffering.

Can I sue a coworker who caused my injury?

Generally, you cannot sue a coworker who injures you while acting within the scope of employment. The workers’ compensation system’s coworker liability shield protects them, just as it protects your employer.

However, exceptions exist. If a coworker intentionally assaults you or their actions were completely unrelated to their job duties, a civil lawsuit may be possible. These complex cases require careful investigation to determine if the coworker’s actions fall outside the protections of the workers’ comp system. If you’re unsure about your case, it’s best to consult an attorney. You can learn more about finding legal help on our Work Injury Attorney Near Me page.

When is Suing Your Employer for Workers Comp a Viable Option?

The exclusive remedy rule has several important exceptions. These are your legal pathways to suing your employer for workers comp outside the standard system. They are narrow and difficult to prove, but they can dramatically change your potential recovery.

These exceptions exist for employer conduct so egregious that limiting recovery to workers’ comp benefits would be unjust. Our Workers Compensation Attorneys California team can evaluate your case to see if you have grounds for a civil lawsuit.

Exception 1: Intentional Injury or Assault

If your employer deliberately hurts you, the exclusive remedy rule does not apply. This includes willful physical assault or creating a situation where injury is practically certain to occur. The challenge is proving intent—that your employer acted with a conscious desire to cause harm. If proven, you can sue for full damages, including pain and suffering and punitive damages. A Hurt at Work Lawyer can help you understand your options.

Exception 2: Fraudulent Concealment

You may have grounds for a lawsuit if your employer knew about a dangerous condition, deliberately hid it from you, and that concealment caused your injury. This is more than just failing to warn; it’s active deception, such as falsifying safety reports about toxic substances like asbestos. Proving fraudulent concealment requires showing your employer had actual knowledge of the hidden danger and intentionally concealed it.

Exception 3: Defective Product (Dual Capacity Doctrine)

Sometimes, your employer is also the manufacturer of a product that injured you. Under the dual capacity doctrine, you may be able to sue them for product liability as a manufacturer, separate from their role as your employer. This is common with defective machinery, such as power presses where safety guards were knowingly removed. These cases require proving the injury stemmed from a product defect, not just a workplace condition. A Workplace Injury Lawyer can help steer this complex doctrine.

What if My Employer Lacks Insurance? The Path to Suing Your Employer for Workers Comp

California law requires all employers to carry workers’ comp insurance. If your employer is uninsured, the exclusive remedy rule does not protect them. This is a clear situation where suing your employer for workers comp is a viable option.

You can still receive benefits through the Uninsured Employers Benefit Trust Fund (UEBTF). Crucially, you can also file a civil lawsuit against your uninsured employer for full damages, including pain and suffering. In such a lawsuit, the burden of proof may shift to your employer, and they face severe penalties. Our Workers Comp Lawsuit Help resources can guide you through this process.

Exception 4: Suing a Negligent Third Party

Even if you can’t sue your employer, you may have a claim against a negligent third party. A third party is anyone other than your employer or a coworker. Common examples include:

- A general contractor or subcontractor on a construction site.

- The manufacturer of defective equipment that caused your injury.

- An at-fault driver in a car accident that occurred while you were working.

A third-party lawsuit allows you to recover damages like pain and suffering, which workers’ comp doesn’t cover. While your employer’s insurer may place a lien on your recovery to be reimbursed for benefits paid, a third-party claim often results in a significantly higher total recovery. A Workplace Accident Attorney can help manage both claims.

Workers’ Comp Benefits vs. Lawsuit Damages: A Comparison

Understanding the difference between workers’ compensation benefits and civil lawsuit damages is crucial for your financial future. Workers’ comp provides a valuable but limited safety net. A lawsuit, if you qualify, can provide much fuller compensation.

Think of it this way: workers’ comp covers immediate needs with caps on recovery, while a lawsuit can address the total impact of your injury, including pain and suffering.

| Feature | Workers’ Compensation Benefits | Civil Lawsuit Damages |

|---|---|---|

| Proof of Fault | Not required (no-fault system) | Required (employer’s intentional wrongdoing, gross negligence, third-party fault) |

| Medical Care | Covered (all reasonable and necessary treatment) | Covered (all past and future medical expenses) |

| Lost Wages | Partial (typically 2/3 of average weekly wage, up to a cap) | Full (past and future lost earnings, including loss of earning capacity) |

| Pain & Suffering | Not covered | Covered |

| Emotional Distress | Not covered | Covered |

| Punitive Damages | Not covered | Possible (in cases of extreme misconduct) |

| Disfigurement | Limited coverage (via permanent disability ratings) | Covered |

| Loss of Consortium | Not covered | Covered (for spouse/family) |

| Legal Process | Administrative claim with Workers’ Compensation Appeals Board | Civil court system |

| Timeline | Generally faster initial benefits | Can be much longer and more complex |

What Damages Can Be Recovered in a Lawsuit?

If you can sue your employer for workers comp under an exception or pursue a third-party claim, the available damages expand significantly.

- Economic damages cover your financial losses, including all past and future medical bills, full lost wages, and diminished future earning capacity.

- Non-economic damages address the human cost of your injury. This includes pain and suffering, emotional distress, disfigurement, and loss of enjoyment of life.

- Punitive damages are rare and are meant to punish an employer for malicious or fraudulent conduct, not to compensate you for losses.

The difference between these damages and standard workers’ comp benefits can be life-changing. Our team can help you Sue for Damages as a Result of Your Injury.

Common Defenses Employers Use in Injury Lawsuits

When you file a lawsuit, expect the defense to fight back. Common defense strategies include:

- Comparative negligence: Arguing you were partially at fault to reduce your compensation.

- Employee misconduct: Claiming you were injured because you violated safety rules.

- Intoxication defense: Alleging that drugs or alcohol caused the accident.

- Injury outside scope of employment: Arguing you weren’t “on the clock” when the injury occurred.

- Statute of limitations: Claiming you missed the legal deadline to file your lawsuit.

- Lack of intent or knowledge: Denying they knew about a hazard or intended to cause harm in cases involving exceptions to the exclusive remedy rule.

Navigating these defenses requires an experienced legal team that knows how to build a compelling case and counter defense tactics.

Critical First Steps After a Work-Related Injury

After a work injury, the steps you take immediately are critical for protecting your rights, whether you file a standard workers’ comp claim or have grounds to sue your employer for workers comp.

Missing a step can jeopardize your claim, so act swiftly.

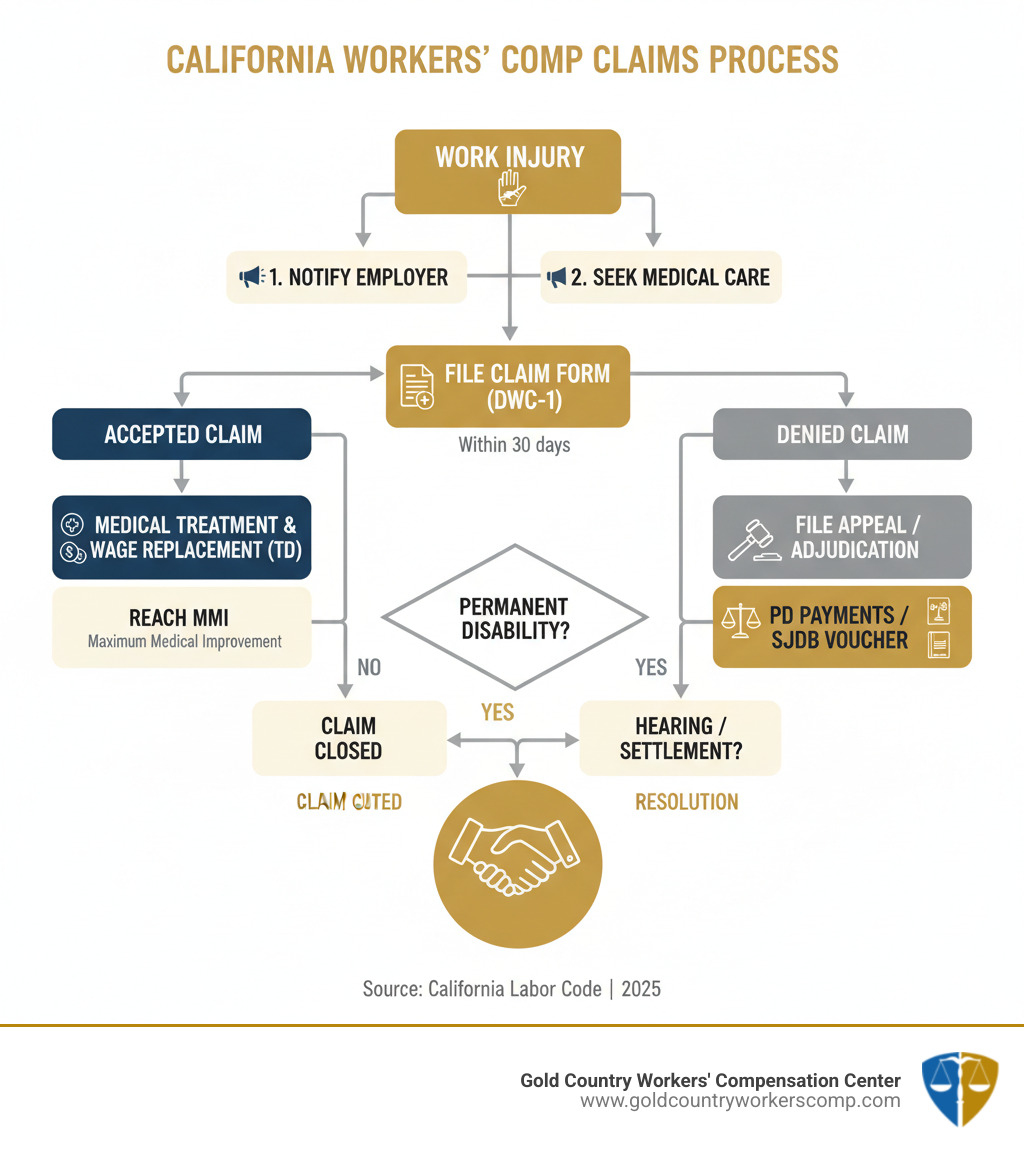

1. Report Your Injury Immediately

This is the most important first step. You must notify your employer in writing within 30 days of your injury. Even minor injuries should be reported, as they can worsen over time.

- Notify your supervisor or designated representative.

- Request and fill out an official incident report.

- Provide accurate details: when, where, and how the injury occurred.

- Get contact information for any witnesses.

Prompt reporting establishes a clear timeline for your claim. For more on this, see our First Step Take Injury Important page.

2. Seek Prompt Medical Treatment

Your health is the priority. Get medical attention right away, even if the injury seems minor. A doctor’s diagnosis and treatment plan create the official medical records that are critical evidence for your claim.

- Go to the emergency room for severe injuries.

- Follow all of your doctor’s instructions and restrictions.

- Keep detailed records of all appointments, diagnoses, and treatments.

- Tell every provider that your injury is work-related.

Delaying treatment can make it harder to prove your injury was work-related. If you’ve been denied care, learn about your options on our Medical Treatment Denied page.

3. File an Official Claim Form

Your employer must give you a Workers’ Compensation Claim Form (DWC-1) within one working day of you reporting your injury.

- Fill out the DWC-1 form accurately and return it to your employer promptly.

- Your employer then forwards it to their insurance carrier.

- The insurer has 90 days to accept or deny your claim. During this time, they must authorize up to $10,000 in medical care.

This form officially starts your claim. If your employer fails to provide it, you can find the official DWC-1 form on the state’s website. Learn more about Making a Workers Comp Claim.

Frequently Asked Questions about Suing an Employer in California

Navigating a work injury claim raises many questions, especially about legal action beyond standard workers’ compensation. Here are answers to some of the most common concerns.

What is the statute of limitations for suing my employer for a work injury?

Filing deadlines are strict and vary by claim type.

- For a workers’ compensation claim, you generally have one year from the date of injury to file the DWC-1 form. You should also report the injury to your employer within 30 days.

- For a personal injury lawsuit against your employer (under an exception) or a third party, you typically have two years from the date of injury to file in civil court.

The “findy rule” can sometimes extend these deadlines if your injury or its connection to work wasn’t immediately apparent, but relying on this is risky. The best course of action is to act promptly to protect your rights.

Do I lose my workers’ comp benefits if I file a lawsuit?

No. Filing a civil lawsuit does not automatically disqualify you from receiving workers’ comp benefits. You can often pursue both claims at the same time (concurrent claims). You can receive medical care and disability payments from workers’ comp while your lawsuit proceeds.

However, California law prevents “double recovery.” If you win a settlement or judgment in your lawsuit, the workers’ comp insurance carrier has a right to be reimbursed for the benefits they paid. This is called an employer’s lien. While this reduces your net lawsuit recovery, the total compensation is often still much higher than from workers’ comp alone.

What evidence is needed for a successful lawsuit against an employer?

The burden of proof is on you when you sue your employer for workers comp under an exception. A strong case is built on solid evidence, including:

- Medical Records: To document the extent of your injuries and connect them to the workplace incident.

- Accident Reports: Official reports filed with your employer or other agencies create a contemporaneous record of the event.

- Witness Statements: Testimony from coworkers who saw the incident or can speak to workplace hazards.

- Photos and Videos: Visual evidence of the accident scene, defective equipment, or your injuries.

- Employer’s Records: Internal emails, safety reports, or maintenance logs can prove your employer’s knowledge of a hazard.

- Expert Testimony: Medical, safety, or engineering experts can provide professional opinions to support your claim.

- Employment Records: Your job description and wage history help establish your financial losses.

Gathering this evidence can be overwhelming. An experienced legal team knows what to look for and how to use it to build the strongest possible case.

Navigating Your Claim with Confidence

The legal landscape for workplace injuries in California is complex. Between the “exclusive remedy” rule and its narrow exceptions, it’s easy to feel overwhelmed while also dealing with pain and financial stress.

The truth is that early legal guidance makes a significant difference. The sooner you consult with an experienced attorney, the better your chances of meeting critical deadlines and pursuing all available compensation, whether through a workers’ comp claim or a civil lawsuit.

That’s where we come in. At Gold Country Workers’ Compensation Center, Kim LaValley and Kyle Adamson have nearly 50 years of combined experience helping injured workers in Roseville, Nevada City, and throughout California. We are committed to ensuring you understand your rights and receive the compensation you deserve.

We believe in early intervention. By contacting us soon after your injury, we can help you avoid common mistakes, gather crucial evidence, and build a strong case from the start. We offer a no-fee initial consultation to give you honest answers about your situation without any upfront cost.

Don’t let uncertainty prevent you from exploring your options. For more information, visit our comprehensive guide: California Workers Compensation Lawyer.

If you have questions about a work injury, contact us today. We’re here to help you move forward with confidence.