Why Preparation Makes or Breaks Your SSDI Application

An SSDI application checklist is your roadmap for one of the most complex government processes you’ll face. Here’s what you need to gather before you apply:

Essential Documents for Your SSDI Application:

- Personal Information: Birth certificate, Social Security number, marriage/divorce records, banking details for direct deposit

- Medical Evidence: Complete list of medical conditions, all healthcare providers’ contact information, medications, test results, and treatment dates

- Work History: Detailed employment records for the past 15 years, including W-2 forms, tax returns, job duties, and earnings

- Education & Training: School completion records, special education details, vocational training certificates

The stakes are high. Approximately 63% of initial SSDI applications are denied, and only 22% of first-time applicants get approved. The initial wait for a decision from the Social Security Administration is typically 3-5 months.

Most denials stem from preventable mistakes like incomplete forms, missing medical records, or gaps in work history. Proper preparation helps you avoid these pitfalls.

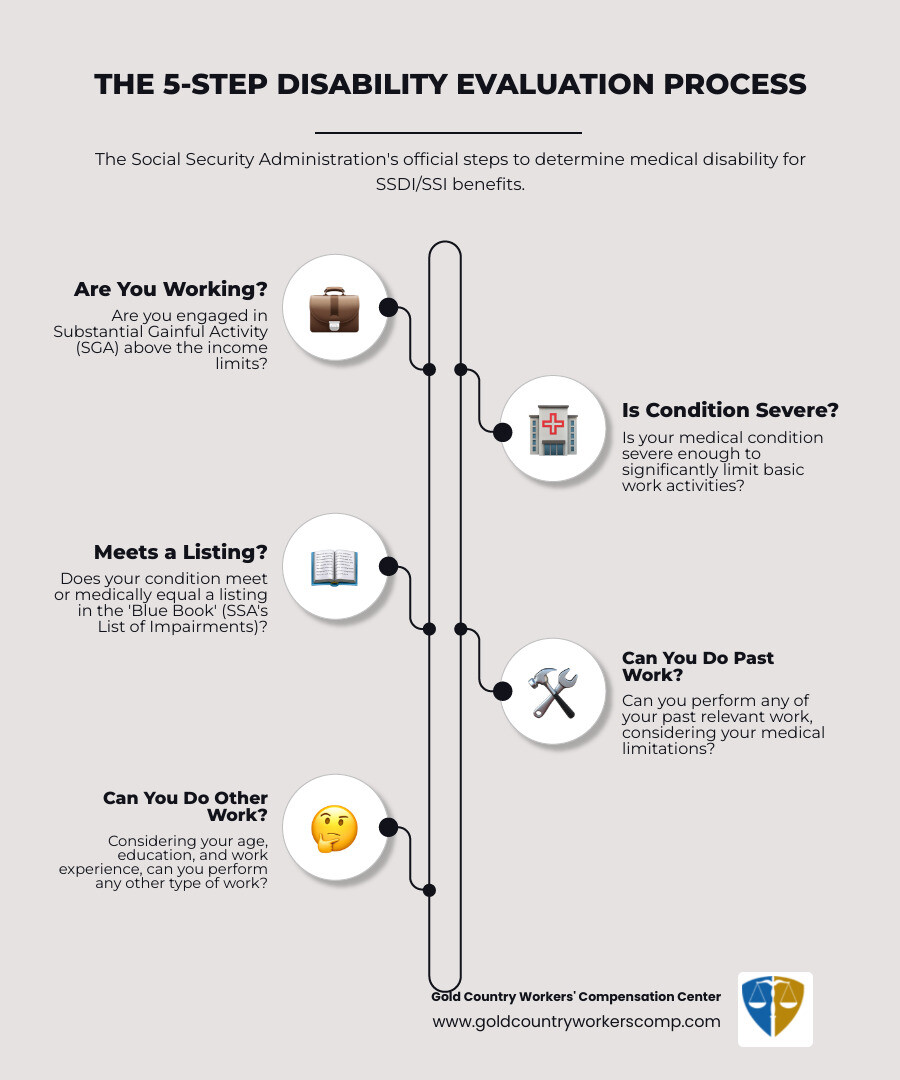

The SSA’s definition of disability is strict: you must be unable to do any substantial work (currently defined as earning $1,310 or more per month) because of a medical condition that’s lasted or will last at least one year, or result in death.

While the SSA can help gather records after you apply, providing complete and organized documents upfront dramatically improves your approval chances and speeds up the process.

Why a Thorough Checklist is Your First Step to Approval

The SSDI application process is notoriously complex. A thorough SSDI application checklist isn’t just helpful—it’s your lifeline. After nearly 50 years of experience, we’ve seen that proper preparation is what separates successful claims from denied ones.

The Social Security Administration requires solid evidence that you cannot perform Substantial Gainful Activity (SGA)—earning more than $1,310 per month—due to a medical condition that will last at least 12 months or is terminal. With only 22% of first-time applicants approved, most denials stem from preventable paperwork mistakes, not ineligibility.

Gathering all your information before you apply builds a compelling case, reduces delays from Requests for Information (RFIs), and gets you closer to the financial support you need.

The Purpose of an SSDI Application Checklist

Think of your SSDI application checklist as a GPS for navigating bureaucracy. Its purpose is to:

- Organize information: It gives you one place to track scattered documents, from birth certificates to W-2s.

- Prevent errors: Methodically working through a list prevents simple mistakes like transposed dates or missing signatures that can derail a strong application.

- Speed up review: A complete, organized application allows SSA examiners to work efficiently, reducing the need for RFIs and potentially shortening the 3-5 month waiting period.

- Build a strong case: Each item on the checklist helps tell your story, giving the SSA a full picture of how your disability affects your ability to work.

- Reduce stress: A clear roadmap turns an overwhelming process into a series of manageable steps, putting you back in control.

Consequences of an Incomplete Application

When applications are incomplete, things go south fast. The consequences include:

- Application rejection: The SSA may reject a seriously incomplete application, forcing you to start over.

- Processing delays: Each Request for Information (RFI) for missing details can add weeks or months to the process.

- Increased chance of denial: With a 63% initial denial rate, incomplete applications are a primary cause. Examiners can’t approve what they can’t verify, so they often default to denial.

- Need for appeals: A denial leads to a lengthy appeals process, from reconsideration to hearings, all of which could have been avoided with a complete initial application.

Your Complete SSDI Application Checklist

This comprehensive SSDI application checklist is based on official SSA resources, including the Checklist for Online Adult Disability Application (June 2024) and the Adult Disability Starter Kit.

Gathering these documents before you apply will save you time and significantly improve your chances of approval.

Part 1: Personal and Household Information

This section covers who you are and the people in your life who may be affected by your claim. The SSA uses this to verify your identity, family situation, and potential benefit amount.

- Birth certificate: A certified copy is best, but a U.S. passport can also work as proof of age.

- Social Security Number (SSN): You will need your own SSN, as well as the SSNs for your current spouse and any minor children.

- Proof of citizenship or alien status: If not a U.S. citizen, have your Permanent Resident Card number and other immigration documents ready.

- Marriage and divorce records: Gather dates, places, and your spouse’s or former spouse’s SSN and dates of birth or death. This helps determine family eligibility for auxiliary benefits.

- Children’s information: Full names, dates of birth, and SSNs for all children under 18, children under 19 still in high school, or adult children disabled before age 22.

- Direct deposit information: Your checking or savings account number and your bank’s 9-digit routing number.

- Alternate contact person: The name, address, and phone number of a friend or family member who knows about your medical conditions.

Part 2: Comprehensive Medical Evidence

This section is critical. Your medical evidence must prove you cannot work due to your medical conditions. Be thorough.

- List of medical conditions: List every illness, injury, and diagnosis that limits your ability to work. Be specific (e.g., type and stage of cancer), as the combination of conditions can be crucial.

- Doctors and healthcare providers: For every provider (doctors, therapists, specialists), list their full name, address, phone number, and dates of your first and last visits.

- Hospitals and clinics: Include the facility’s name, address, phone number, and your dates of admission and discharge for any ER visits, inpatient stays, or outpatient procedures.

- Dates of treatments: Document all surgeries, procedures, and ongoing therapies with specific dates.

- Medications and prescriptions: Create a complete list of current and past medications, noting what each is for and who prescribed it.

- Medical tests and results: List all tests (X-rays, MRIs, blood work, etc.), including the type of test, when it was done, and who ordered it.

- Other benefit records: If you’ve received Workers’ Compensation benefits, vocational rehabilitation, or other disability benefits, include claim numbers, settlement agreements, and payment amounts.

Note: The SSA can request medical records for you, but providing copies of what you already have can speed up the process. Do not pay to request records you don’t have; the SSA will obtain those at no cost to you.

Part 3: Work, Education, and Training History

Your work history explains what you can no longer do. This section is crucial, as SSDI eligibility depends on work credits earned through Social Security taxes.

- Job history for the past 15 years: List every job (full-time, part-time, or self-employment) before your disability began.

- Employer’s name, address, and phone number: Provide this for each position.

- W-2 forms or tax returns: Have these for the current and past two years to verify earnings.

- Job duties: For each job, detail your daily tasks, skills, tools used, and physical demands (lifting, standing, etc.). Crucially, explain why your medical condition now prevents you from performing these duties.

- Pay rates: Include your gross wages per month or year for each job.

- Education level: State the highest grade you completed, along with dates and locations.

- Special education: If you received special education, include those details.

- Job training or vocational school: List any specialized trade schools or vocational programs you’ve completed, with dates.

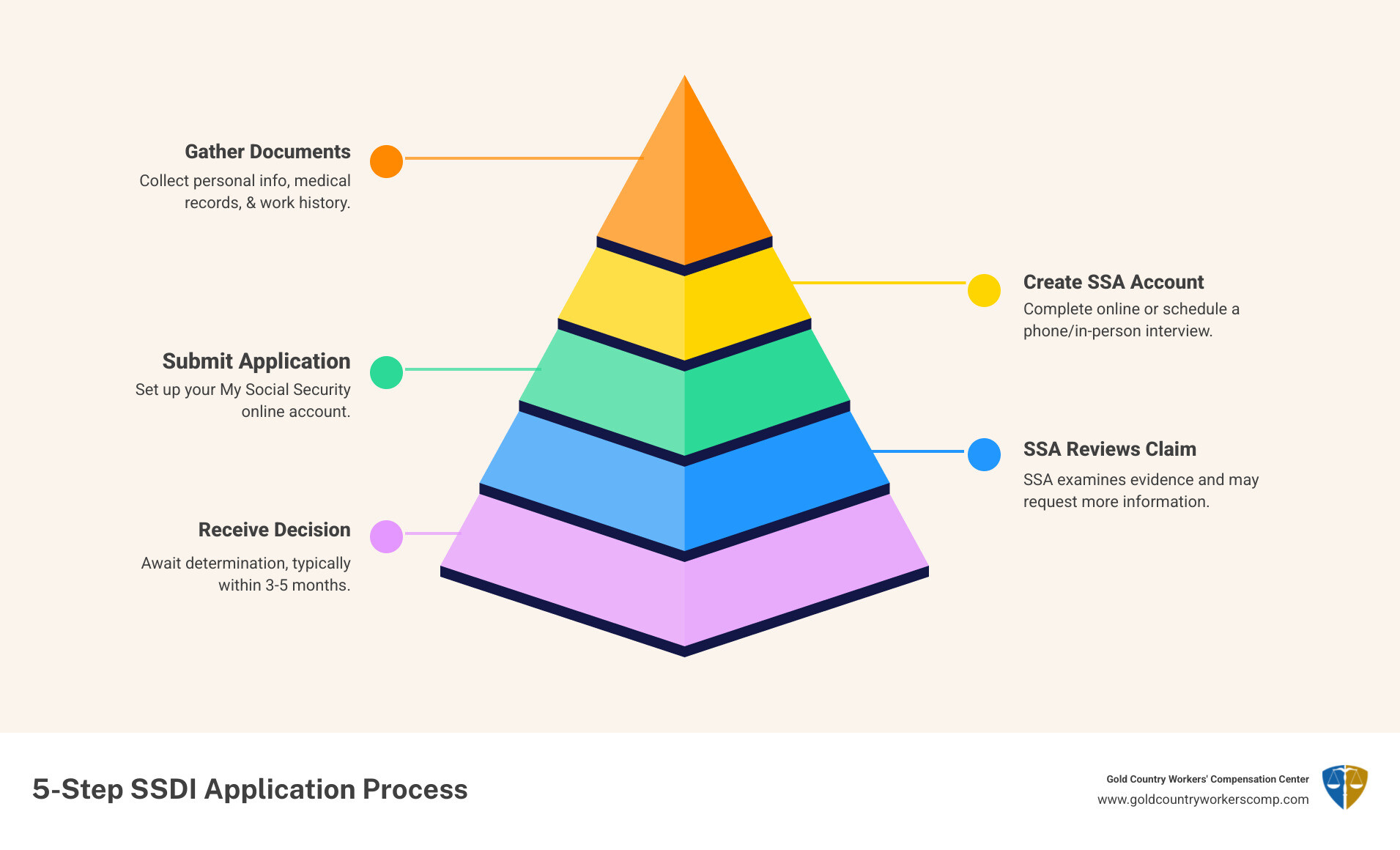

Navigating the Application: From Gathering to Filing

With your SSDI application checklist complete, it’s time to file. The SSA offers three flexible ways to apply.

- Apply online: The application at Apply Online for Disability Benefits lets you start, save, and return to your work. You’ll first need to create a secure ‘my Social Security’ account.

- Apply by phone: You can call the SSA’s toll-free number at 1-800-772-1213 (or 1-800-325-0778 for TTY) to apply over the phone.

- Apply in person: Call your local Social Security office to schedule an in-person appointment.

Having your organized SSDI application checklist beside you will make any application method flow smoothly.

What If You’re Missing Information?

A common question is whether to wait to apply if you’re missing documents. The answer is no: Don’t delay filing your application!

The SSA knows gathering records is challenging and is set up to help you after you file. Once you sign the medical release form, the SSA will work to obtain missing medical evidence directly from your providers at no cost to you.

If you know something is missing, inform the SSA representative. The most important thing is to get your application filed to establish your filing date.

A legal representative, like our team at Gold Country Workers’ Comp, can be invaluable here. With nearly 50 years of combined experience, we know which documents are critical upfront and can help you organize your file and work with the SSA to obtain the rest, preventing delays.

Starter Kits vs. Online Checklists: What’s the Difference?

The SSA provides several helpful resources that serve slightly different purposes:

- The Adult Disability Starter Kit (like the Adult Disability Starter Kit): This is a general guide for organizing your information, whether you apply online or via interview.

- The online application checklist (such as the Checklist for Online Adult Disability Application (June 2024)): This is a specific, step-by-step guide for completing the digital application.

- The Adult Disability Interview Checklist (found at Adult Disability Interview Checklist): This prepares you for a phone or in-person interview, outlining what to have on hand.

Using these resources together provides the most complete preparation, leading to a more confident and less stressful application process.

Frequently Asked Questions about the SSDI Application

With nearly 50 years of experience helping Californians, we’ve heard the same questions time and again. Here are the most common concerns.

What are the key differences in the application for an adult versus a child?

Adult and child disability applications are quite different, starting with the programs. Adults typically apply for Social Security Disability Insurance (SSDI), which is based on work history. Children, who have no work history, usually apply for Supplemental Security Income (SSI), a needs-based program.

The eligibility standards also differ. For adults, the SSA assesses the ability to perform Substantial Gainful Activity (SGA). For children, the standard is whether an impairment causes “marked and severe functional limitations” that affect daily activities and development.

The SSA provides a specific Child Disability Starter Kit to help parents prepare, which focuses on a child’s schooling and medical history rather than employment.

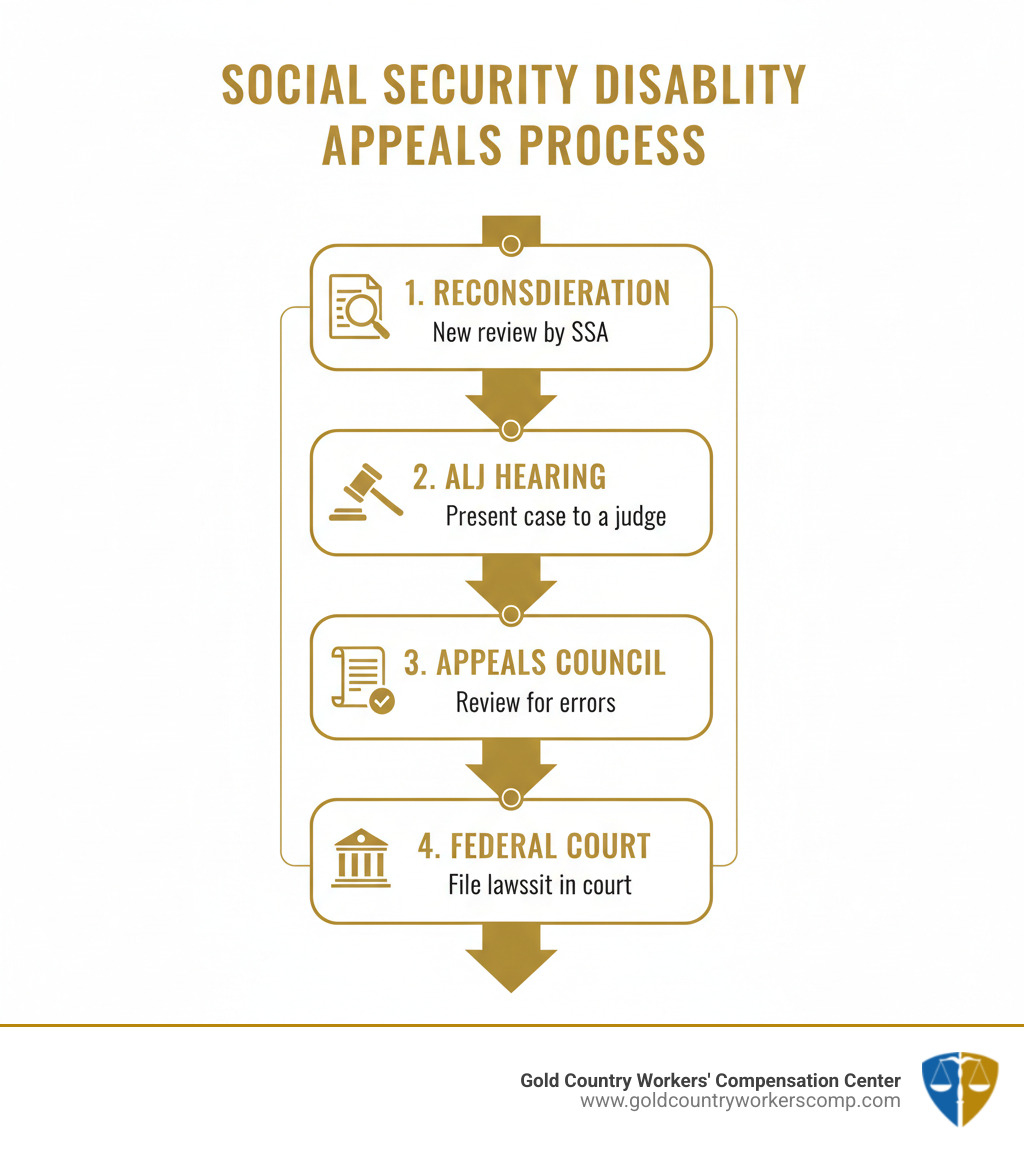

What happens if my initial SSDI application is denied?

If you receive a denial letter, you’re in the majority—63% of initial applications are denied. This doesn’t mean you don’t qualify; it means you must begin the appeals process.

You have the right to appeal, and many who are initially denied win on appeal. The process has several stages:

- Reconsideration: A new examiner reviews your case along with any new evidence you provide.

- Hearing before an Administrative Law Judge (ALJ): This is often where cases turn around. You can present your case in person, bring witnesses, and have legal representation.

- Further Appeals: Beyond the ALJ hearing, there is the Appeals Council Review and Federal Court Review.

Critically, you have only 60 days from receiving a denial letter to file your appeal. Missing this deadline can force you to start the entire application process over.

Can a legal representative help me gather documents and apply?

Absolutely. At Gold Country Workers’ Comp, our nearly 50 years of experience can be a significant advantage. We understand how overwhelming the SSDI application checklist is when you’re also managing a disability.

We help identify and obtain crucial medical records, ensure forms are completed correctly to meet SSA standards, communicate with the SSA on your behalf, and manage all critical deadlines to prevent your case from being derailed. Our assistance can reduce your stress and free you to focus on your health.

Our early intervention approach means there’s no initial consultation fee. We are committed to helping you achieve a positive outcome. Given the high initial denial rate, experienced legal representation can make all the difference.

Get Expert Help with Your SSDI Application

You now understand how detailed the SSDI application checklist is. When you’re managing a disability, navigating this bureaucracy is an added stress you don’t need.

Even with perfect preparation, the process is challenging. With a 63% initial denial rate and only 22% of first-time applicants approved, the odds can feel stacked against you. You don’t have to face this alone.

At Gold Country Workers’ Comp, we’ve spent nearly 50 years helping people in California with Workers’ Compensation and Disability/Social Security claims. Our team, led by Kim LaValley and Kyle Adamson, knows what the SSA is looking for and how to build a strong claim.

We believe in early intervention, which is why we offer a free initial consultation. Whether you’re just starting your SSDI application checklist in Roseville, responding to a request for information in Nevada City, or considering an appeal anywhere in California, we can help.

Our approach is to build the strongest possible case from the start. We help identify evidence gaps, ensure forms are accurate, communicate with the SSA, and manage all critical deadlines. We’ve helped countless individuals achieve a positive outcome.

Take the next step and let our experience work for you. Contact a California disability attorney for a free consultation today, and let’s get your SSDI application handled with the expertise and personal attention it deserves.