Why Understanding Social Security Disability Benefits Matters

Social Security disability advice can be overwhelming when a medical condition prevents you from working. Understanding your options quickly is crucial.

Quick Answer: Essential Steps for Social Security Disability Benefits

- Determine your eligibility – You need either enough work history (SSDI) or limited income/resources (SSI).

- Understand the disability definition – Your condition must prevent substantial work for at least one year or be terminal.

- Gather your documentation – Collect medical records, work history, and personal information.

- Apply through SSA – Apply online, by phone, or in person (expect a 6-8 month initial review).

- Be prepared for denial – Most initial applications are denied; appeals are common and often successful.

- Consider professional help – A disability attorney can improve your chances in a complex process.

The reality is stark: a 20-year-old worker has a 1-in-4 chance of developing a disability before reaching full retirement age, yet the process to get benefits is complicated.

The Social Security Administration (SSA) runs two main programs: Social Security Disability Insurance (SSDI) for workers who’ve paid into the system, and Supplemental Security Income (SSI) for people with limited income and resources, regardless of work history.

Both programs use the same strict definition of disability: you must be unable to do substantial work due to a medical condition that will last at least one year or is expected to result in death. Partial or short-term disabilities do not qualify.

The application process averages 6 to 8 months, and many initial claims are denied. Understanding how the SSA evaluates claims and what evidence they need is key to success.

Social Security disability advice terms made easy:

- Social Security benefits in Roseville CA

- Roseville CA Social Security Office

- Roseville Social Security Office Appointments

Understanding Your Eligibility: SSDI vs. SSI

Figuring out which Social Security disability program you might qualify for is a critical first step. The Social Security Administration (SSA) runs two distinct programs for people with disabilities: Social Security Disability Insurance (SSDI) for those who have worked and paid into the system, and Supplemental Security Income (SSI) for those with limited financial means.

Both programs use the same strict definition of disability. Your medical condition must prevent you from performing Substantial Gainful Activity (SGA)—earning above a certain monthly amount. However, the non-medical qualifications for each program are very different. In California, SSI recipients may also receive a state supplement, which adds to the federal benefit amount.

What are SSDI and SSI?

Understanding the difference between these programs is essential Social Security disability advice.

Social Security Disability Insurance (SSDI) is an insurance program funded by Social Security taxes from your paychecks. To qualify, you must have earned enough work credits by working and paying taxes long enough and recently enough. If approved, your benefit amount is based on your average lifetime earnings, and you become eligible for Medicare after a two-year waiting period.

Supplemental Security Income (SSI) is a needs-based program funded by general tax revenues. It does not require a work history. Eligibility is determined by your income and resources, which must be below strict federal limits. SSI provides a fixed monthly benefit, which California supplements. SSI recipients in California are typically eligible for Medicaid (Medi-Cal) immediately.

It’s possible to qualify for both programs simultaneously, which is known as receiving concurrent benefits. This occurs if you are eligible for SSDI but your monthly benefit is low enough to also meet SSI’s financial criteria.

| Feature | Social Security Disability Insurance (SSDI) | Supplemental Security Income (SSI) |

|---|---|---|

| Eligibility | Based on work history and payment of Social Security taxes (work credits). | Based on financial need (limited income and resources); no work history required. |

| Funding Source | Social Security taxes (payroll deductions). | General tax revenues. |

| Benefit Amt. | Varies based on average lifetime earnings. | Fixed federal benefit rate, potentially supplemented by state funds (like in California), reduced by countable income. |

| Health Benefits | Medicare coverage automatically after 2 years of disability benefit receipt. | Medicaid (Medi-Cal in California) eligibility usually begins immediately upon SSI approval. |

| Dependents | Certain family members (spouse, children) may be eligible for benefits on your work record. | Generally, no additional benefits for dependents, though a child can receive SSI if disabled and meets financial criteria. |

| Taxable? | May be taxable depending on your total income. | Generally not taxable. |

How the SSA Determines You Are Disabled

The SSA’s definition of disability is purely legal and can differ from your doctor’s opinion. You are considered disabled only if a medical condition prevents you from doing substantial work for at least one year or is expected to be terminal. Partial or short-term disability does not qualify.

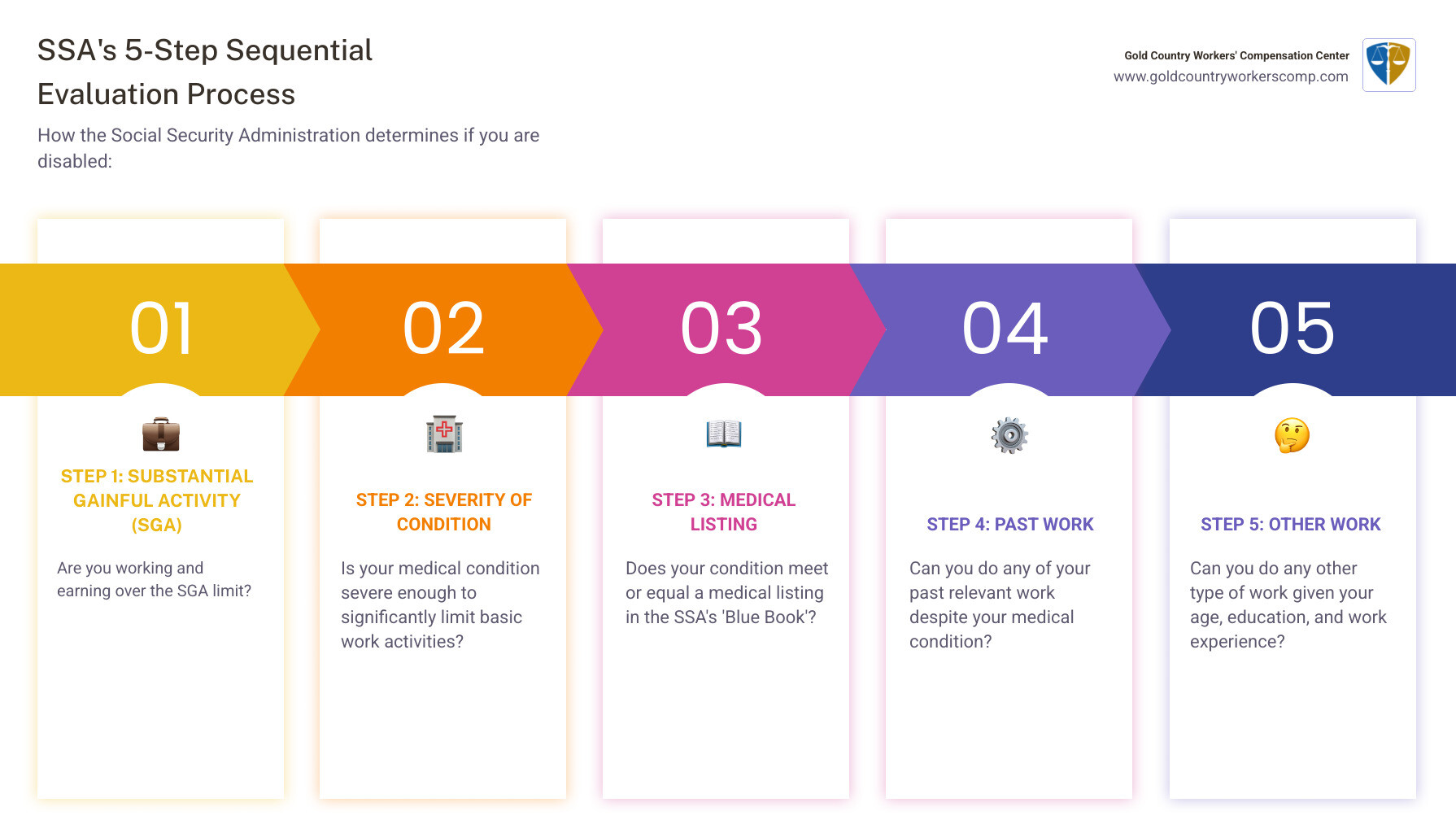

While your doctor’s opinion is important medical evidence, the SSA uses a rigid 5-step evaluation process to make its decision:

- Are you working? If you are earning above the SGA limit, you generally won’t be considered disabled.

- Is your condition severe? Your condition must significantly limit basic work activities.

- Does your condition meet a listing? The SSA compares your condition to its Listing of Impairments (the “Blue Book”).

- Can you do your past work? If your condition doesn’t meet a listing, the SSA assesses if you can perform any of your past jobs.

- Can you do any other work? If you can’t do your past work, the SSA considers your age, education, work experience, and Residual Functional Capacity (RFC)—what you can still do despite your limitations—to determine if you can perform other work.

To get a preliminary idea of your eligibility, you can use the Social Security benefits questionnaire on the SSA’s website.

The Application Process: A Step-by-Step Guide

Applying for Social Security disability benefits is a lengthy process, with initial decisions often taking 6 to 8 months. While the wait can be difficult, proper preparation can make the journey less overwhelming.

Think of the application as building a case to prove your medical condition prevents you from working and will last at least a year or is terminal. You can apply online, by phone, or in person at a local Social Security office, including those serving the Roseville and Nevada City areas. Once submitted, your application is sent to your state’s Disability Determination Services (DDS) for a medical review.

Gathering Your Documents: Essential Social Security Disability Advice

Complete documentation is critical to your claim’s success. The SSA’s Adult Disability Starter Kit can help you organize the necessary information:

- Personal Information: Birth certificate, Social Security number, and proof of citizenship or legal status.

- Medical Records: A complete list of all doctors, hospitals, and clinics, including contact information and dates of treatment. Incomplete medical information is a primary cause of delays and denials.

- Medication List: All prescribed medications, including dosages and prescribing doctors.

- Work History: A 15-year work history with job titles, dates, and specific physical and mental duties for each position.

- Education and Training: Your highest level of schooling, vocational training, and any special skills.

- Financial Information (for SSI): Details about your income, bank accounts, and other resources to prove you meet the strict financial limits.

Common Reasons for Claim Denials

Most initial applications are denied, but often for fixable reasons. Understanding these common pitfalls can help you prepare a stronger claim.

- Insufficient Medical Evidence: The SSA needs objective medical proof of your diagnosis, symptoms, and functional limitations. A simple doctor’s note is not enough.

- Earning Above the SGA Limit: If your monthly earnings exceed the Substantial Gainful Activity (SGA) limit ($1,550 in 2024 for non-blind individuals), your claim will be denied.

- Failure to Follow Prescribed Treatment: The SSA may deny your claim if you don’t follow your doctor’s treatment plan without a valid reason, such as cost or significant risk.

- Lack of Cooperation: Failing to respond to SSA requests or attend scheduled exams can lead to a denial.

- Application Errors: Incomplete or inconsistent information on the complex application forms can cause delays or denials.

- Disability is Not Long-Term: Your condition must be expected to last at least 12 months or be terminal.

Navigating Denials and Appeals: Key Social Security Disability Advice

Receiving a denial letter is disheartening, but it’s not the end of the road. The most crucial piece of Social Security disability advice is: don’t give up. Most initial applications are denied, and the appeals process is where many claimants eventually win their benefits.

You have a strict 60-day deadline from the date you receive the denial to file an appeal. Missing this deadline could force you to start the entire application process over.

The Four Levels of the Appeals Process

The SSA provides a four-level appeals process, giving you multiple chances to strengthen your case with new evidence.

- Reconsideration: A new examiner reviews your file and any new medical evidence. In California, this is a paper review, and denials are still common at this stage.

- Administrative Law Judge (ALJ) Hearing: This is a critical stage where you appear before a judge. You can present new evidence, bring witnesses, and explain how your disability affects you. Your chances of approval often increase significantly at this level.

- Appeals Council Review: If the ALJ denies your claim, you can ask the Appeals Council to review the decision for legal errors. The Council can uphold the decision, reverse it, or send the case back to the ALJ.

- Federal Court Review: The final step is filing a civil lawsuit in U.S. District Court. This is a legally complex process that typically requires an attorney.

You can learn how you can appeal on the SSA’s official website.

How to Prepare for Your Disability Hearing

The ALJ hearing is often the best opportunity to win your case. Thorough preparation is key.

- Continue Medical Treatment: Keep seeing your doctors and gathering new medical records. The judge needs to see current, ongoing evidence of your condition.

- Get Detailed Doctor Statements: Ask your physicians for specific statements about your functional limitations (e.g., how long you can stand, how much you can lift).

- Prepare Witness Testimony: Your spouse, friends, or family can testify about your daily struggles and how your condition has impacted your life.

- Understand the Questions: Be prepared to answer questions from the judge about your condition, symptoms, daily activities, and work history.

- Work with a Disability Attorney: This is perhaps the most valuable Social Security disability advice. An experienced attorney knows how to build a strong case, prepare you for the hearing, and present legal arguments to the judge. In our experience serving Roseville and Nevada City, professional representation significantly increases the chances of turning a denial into an approval.

Managing Your Benefits After Approval

Congratulations on your benefit approval! While this is a major relief, your relationship with the SSA continues. You have ongoing responsibilities and opportunities to manage your benefits effectively.

Once approved, you will undergo periodic Continuing Disability Reviews (CDRs) to confirm you are still disabled. The frequency of these reviews (from 18 months to 7 years) depends on whether medical improvement is expected. You must also report any changes in your work status, income, or address to the SSA to avoid overpayments.

Your approval also comes with healthcare coverage. SSDI recipients get Medicare after a 24-month waiting period, while SSI recipients in California typically get Medicaid (Medi-Cal) immediately. You may also consider opening an ABLE account, a tax-advantaged savings account for disability-related expenses.

Working While Receiving Benefits

One of the most empowering pieces of Social Security disability advice is that you can try to return to work. The SSA offers Work Incentives to help you do so without immediately losing your benefits.

- Trial Work Period (TWP): SSDI recipients get 9 months to earn any amount of money while keeping their full benefits.

- Extended Period of Eligibility: After the TWP, you have a 36-month period where you receive benefits for any month your earnings fall below the SGA level.

- Impairment-Related Work Expenses (IRWE): The cost of items you need for work due to your disability can be deducted from your earnings, potentially allowing you to earn more while keeping benefits.

- Ticket to Work Program: This free, voluntary program offers employment support services to help you find and keep a job.

For complete details, consult the SSA’s Red Book – A Guide to Work Incentives.

Understanding Changes to Your Benefits

Your benefits can change over time. It’s crucial to report any changes in your work, income, living situation, or legal status to the SSA.

Be aware that SSDI benefits may be taxable depending on your total household income, while SSI benefits are generally not. When you reach full retirement age, your SSDI benefits will automatically convert to retirement benefits, usually at the same amount. Understanding these rules is vital for long-term financial planning.

Conclusion

Navigating the Social Security disability system is a complex journey, filled with intricate rules and potential setbacks. It can feel overwhelming, especially while managing a health condition that prevents you from working.

However, with the right Social Security disability advice and a clear understanding of the process, you can significantly improve your chances of success. We’ve covered the differences between SSDI and SSI, the SSA’s definition of disability, the application and appeals process, and how to manage your benefits after approval.

You don’t have to walk this path alone. For nearly 50 years, Gold Country Workers’ Comp has been a trusted hand for folks in California, helping them through the Workers’ Compensation and Disability/Social Security maze. We’re all about stepping in early, offering expert guidance right from the start with no initial consultation fee. Our goal is always to find cost-effective solutions and achieve positive outcomes for people just like you in Grass Valley, Roseville, Nevada City, and beyond. Our team, including Kim LaValley and Kyle Adamson, is passionate about helping you resolve your issues and move forward.

If you’re struggling with a disability and need a helping hand with your SSDI or SSI claim, or if you’ve faced a denial and need help with an appeal, please know we’re here for you. Let us help you open up the benefits you’re entitled to.