Why Every California Worker Needs to Know Their Workers’ Comp Rights

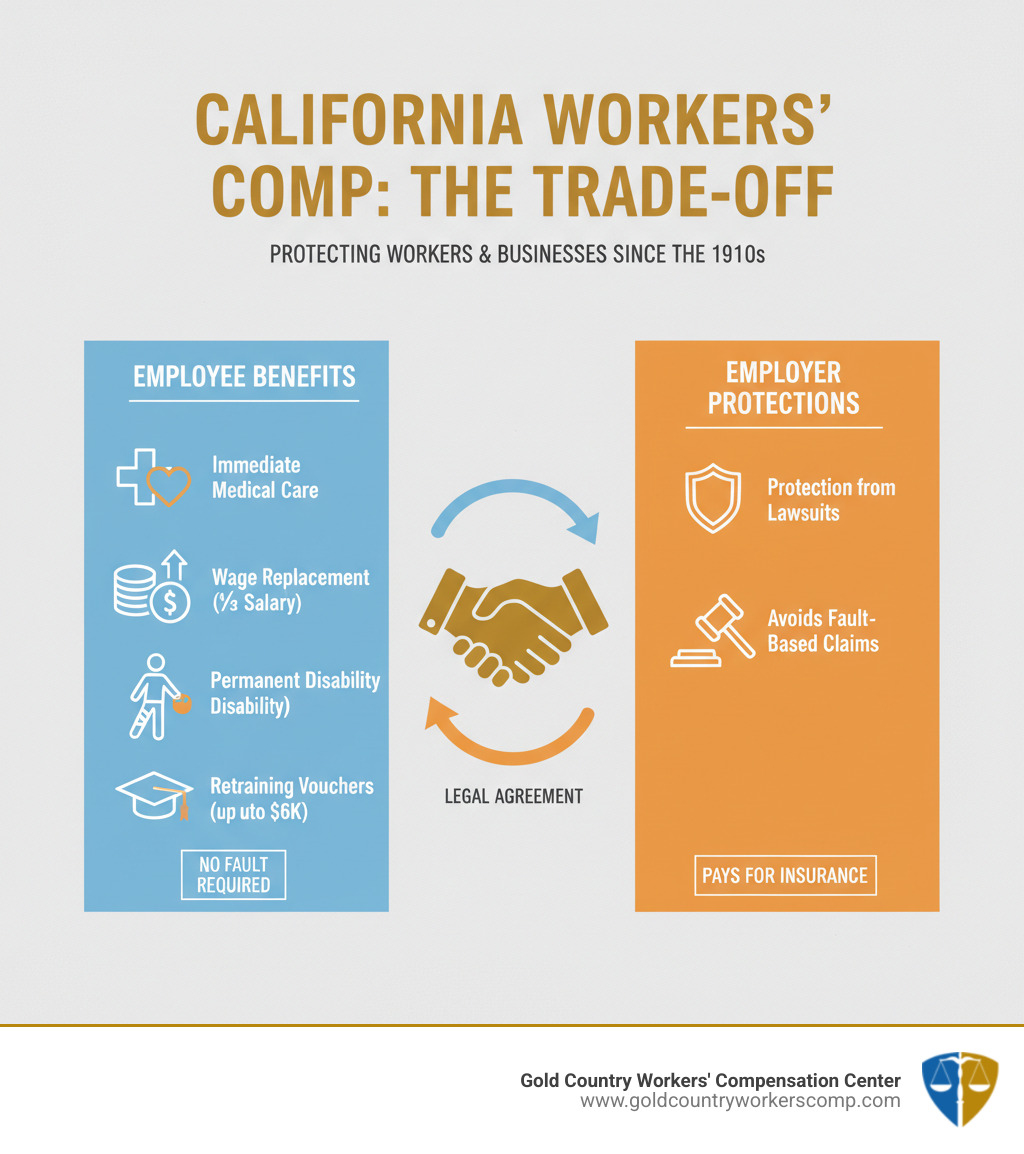

California workers comp law creates a no-fault system that protects both employees and employers when workplace injuries occur. Whether you’re a construction worker, office employee, or restaurant staff member, this law determines what benefits you receive if you’re hurt on the job—and what your employer must provide.

Quick Answer: What is California Workers Comp Law?

California’s workers’ compensation system provides these core protections:

- Medical Coverage: All necessary treatment for work-related injuries, paid by your employer’s insurance

- Wage Replacement: Up to two-thirds of your pre-tax wages while you recover (maximum 104 weeks for temporary disability)

- Permanent Disability: Ongoing payments if you can’t fully return to work

- Retraining Support: Up to $6,000 voucher for job retraining if you can’t return to your old job

- No-Fault Protection: You receive benefits regardless of who caused the injury

- Employer Shield: In exchange, employers are protected from most workplace injury lawsuits

The system is California’s oldest social insurance program, dating back to the 1910s. It operates on a simple trade-off: injured workers get prompt medical care and wage replacement without proving fault, while employers avoid costly lawsuits.

But here’s what most workers don’t realize: the system is complex. Missing a 30-day reporting deadline can jeopardize your claim. Not understanding your rights to choose a doctor can affect your treatment. And employers who fail to carry insurance face penalties up to $100,000—but that doesn’t help you if you’re already injured and they’re uninsured.

This guide breaks down everything you need to know about California workers comp law in plain language. We’ll walk you through who’s covered, what benefits you can receive, how to file a claim, what to do if it’s denied, and when you need professional help.

Who is Covered and Who is Obligated?

Understanding who needs workers’ compensation coverage in California is essential for any business. It’s about following the law and protecting your employees and your business from devastating financial consequences.

Here’s the bottom line: if you have even one employee in California, you must carry workers’ compensation insurance. This applies whether they are full-time, part-time, or temporary. The moment you hire someone, you are legally required to have coverage.

California workers comp law defines an employee broadly, including full-time, part-time, temporary, seasonal workers, and minors. If someone works for you for wages, they are almost certainly covered.

Most businesses buy a policy from a licensed carrier. Larger companies meeting strict financial requirements may qualify for self-insurance, with approval from the Department of Industrial Relations, Office of Self-Insurance Plans. Out-of-state employers with employees regularly working in California must also have California workers’ comp coverage. The location of the work, not the headquarters, dictates the requirement.

Understanding Exemptions from California Workers Comp Law

Certain individuals are exempt from coverage, which can be a point of confusion for business owners.

Sole proprietors and single-member LLCs with no employees are not required to have workers’ comp for themselves. However, the moment you hire anyone, even part-time, you need coverage.

Corporate officers who own their corporation, partners in a partnership, and members of an LLC can sometimes elect to exclude themselves from coverage. However, any employees they hire must be covered.

Roofing contractors are a notable exception: they must carry workers’ compensation insurance even if they have no employees, due to the hazardous nature of the work.

The independent contractor distinction is tricky. True independent contractors are not covered, but misclassifying an employee as one can lead to serious legal trouble. The classification depends on the actual working relationship (control over work, tools provided, etc.), not just a contract.

Volunteers for nonprofit organizations are typically not covered, but if they receive payment beyond expense reimbursement, they may be considered employees.

Employer Responsibilities at a Glance

Once you have coverage, you must fulfill several key obligations:

Purchase the right insurance. Your policy must meet California’s minimum requirements: $100,000 per occurrence, $100,000 per employee, and $500,000 total policy value. Never let your coverage lapse.

Post the required notices. Display the official “Notice to Employees” poster in a visible area, like a break room. This poster explains their workers’ comp rights.

Give new hires the information they need. Provide every new employee with a pamphlet explaining workers’ compensation benefits and procedures.

Respond immediately when someone gets hurt. You have one working day to provide an injured employee with a claim form (DWC-1) after they report an injury.

Authorize medical treatment right away. Within one working day of receiving the claim form, you must authorize up to $10,000 in medical care while the claim is investigated.

Following these rules is crucial. It ensures injured workers get the care they need and protects businesses from costly penalties and lawsuits.

A Complete Guide to Workers’ Compensation Benefits

When you’re hurt at work, your first thought is probably “how am I going to pay my bills?” or “who’s going to cover my medical treatment?” The good news is that California workers comp law was designed exactly for these moments. The system provides five main types of benefits to help you through recovery and beyond.

Medical Treatment and Care

The first thing you need after a work injury is proper medical care, and your employer’s workers’ compensation insurance must cover all treatment reasonably required to cure or relieve the effects of your injury. This isn’t just a quick doctor’s visit—it’s comprehensive care.

Your medical benefits cover physician visits with doctors, specialists, and surgeons. They cover hospital services including emergency room care, hospital stays, and any surgical procedures you need. Prescription drugs that treat your injury are covered, along with medical equipment like crutches, wheelchairs, or braces. Diagnostic work such as lab tests and X-rays fall under coverage too, as does physical therapy and rehabilitation to help you regain function.

Here’s something many workers don’t realize: you can even get reimbursed for travel costs to and from medical appointments. As of January 1, 2025, that’s 70 cents per mile. It might not sound like much, but those miles add up when you’re making multiple trips to specialists.

Now, there’s a catch that trips up some people. Many employers use what’s called a Medical Provider Network (MPN) or Health Care Organization (HCO). These are groups of healthcare providers that the insurance company contracts with. If your employer has an MPN, you’ll generally need to choose a doctor from that network.

But here’s where you have some control: you might have the right to predesignate a personal physician to treat your work injury if you meet certain conditions before the injury happens. This means if you have a doctor you trust, you can potentially designate them in advance. For the full details on medical care rights, the California Labor Code on medical care spells it all out.

Disability and Wage Replacement Payments

Missing work because of an injury is stressful enough without worrying about how you’ll pay rent. That’s where disability payments come in under California workers comp law.

Temporary Disability (TD) payments replace wages you lose while you’re recovering and can’t work. The calculation is straightforward: you receive two-thirds (66.67%) of your average pre-tax weekly wage. Of course, there are state-mandated minimum and maximum amounts. For injuries after January 1, 2021, the maximum weekly benefit is $1,356.31.

These payments typically last up to 104 weeks within a five-year period from your injury date. That’s just over two years of coverage. However, if you suffer certain severe conditions—think HIV, severe burns, or amputation—temporary disability can extend up to 240 weeks. You can read more about temporary disability payments in the Labor Code.

But what happens if your injury leaves lasting effects? That’s where Permanent Disability (PD) payments come in. If your injury results in a lasting impairment that reduces your earning capacity even after you’ve reached maximum medical improvement (when your doctor says you’re as healed as you’re going to get), you may receive permanent disability benefits.

The amount and duration depend on your disability rating, which is determined by a specific rating schedule. This rating considers the nature of your injury, your age, your occupation, and any work restrictions your doctor imposes. It’s a complex calculation, but it’s designed to compensate you fairly for your reduced earning capacity.

For the most severe cases—disabilities rated between 70% and 99%—California provides a life pension. This means you receive ongoing payments for the rest of your life, recognizing that some injuries fundamentally change your ability to earn a living.

Retraining and Other Financial Support

Sometimes an injury doesn’t just sideline you temporarily—it changes your career path entirely. California workers comp law recognizes this reality and offers programs to help you transition.

The Supplemental Job Displacement Benefit (SJDB) provides a $6,000 voucher if your permanent work injury prevents you from returning to your old job and your employer doesn’t offer you modified or alternative work. This isn’t cash in your pocket, but rather a voucher you can use for education-related retraining at state-approved schools, skill improvement courses, or even tools and equipment necessary for a new career. Think of it as a bridge to your next chapter.

There’s also the Return-to-Work Supplement Program (RTWSP) for injuries on or after January 1, 2013. If you received an SJDB voucher and experienced a disproportionate loss of earnings, you may qualify for a one-time supplemental payment administered by the Department of Industrial Relations. It’s designed to help bridge that financial gap when your new career doesn’t quite match your old earning power.

Now, California workers comp law is meant to be your primary safety net for work injuries, but it’s not the only program out there. State Disability Insurance (SDI) is a state program that provides short-term wage replacement for non-work-related illnesses or injuries. Sometimes it can complement workers’ comp benefits, or serve as a fallback if your workers’ comp claim gets denied.

For truly severe, long-term disabilities, Social Security Disability Insurance (SSDI) might be available. This federal program kicks in if your work injury results in a total disability that prevents you from performing any substantial gainful activity. The qualification standards are different from workers’ comp, but it’s worth exploring if your injury is that severe.

Finally, here’s something most people don’t think about: third-party lawsuits. If your injury was caused by someone other than your employer—say, a defective piece of equipment or another company’s negligent driver—you might be able to pursue a personal injury lawsuit against that third party. This is separate from your workers’ comp claim and could provide additional compensation. It’s rare, but when it applies, it can make a significant difference in your recovery, both physical and financial.

Navigating the California Workers Comp Law: The Claims Process

Here’s the truth: knowing what benefits you’re entitled to is one thing, but actually getting them requires navigating a process that can feel overwhelming when you’re already dealing with pain and uncertainty. The good news? Once you understand the steps, it becomes much more manageable.

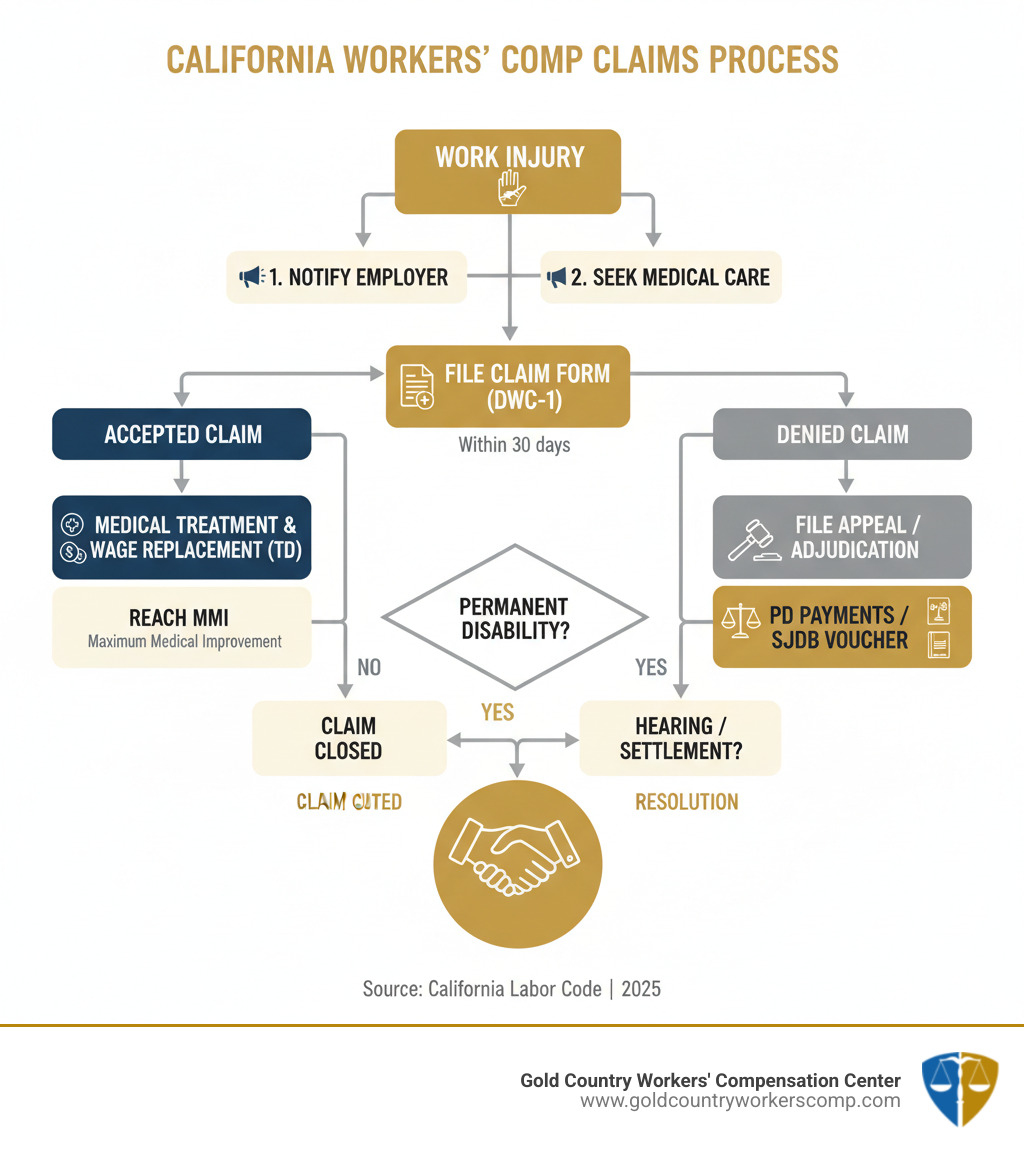

What to Do Immediately After a Work Injury

The actions you take in those first hours and days after an injury can make or break your claim. Let’s walk through what needs to happen.

Your health comes first, always. If you need immediate medical attention, get it right away. Don’t wait, don’t second-guess yourself, and don’t let anyone tell you to “tough it out.” When you’re being treated, make sure you tell the medical staff that your injury happened at work. This simple statement creates a medical record that links your injury to your job.

Next, tell your supervisor what happened. This notification should happen as soon as possible—ideally the same day. Even if the injury seems minor, report it. Many serious conditions start as small problems that worsen over time.

While a quick verbal heads-up gets things started, California workers comp law requires something more formal: written notice to your employer within 30 days of your injury. This doesn’t have to be fancy—a simple written statement describing when, where, and how you were injured is enough. But this written notice is crucial. It creates a paper trail and starts the legal clock ticking on your claim.

Finally, ask your employer for a claim form. They’re legally required to give you a DWC-1 form within one working day of learning about your injury. If they drag their feet or refuse, you can download the DWC-1 Claim Form yourself from the state website.

Key Deadlines Under California Workers Comp Law

Here’s where things get serious. Workers’ compensation runs on strict deadlines, and missing them can cost you everything. These aren’t flexible guidelines—they’re legal requirements that the system takes very seriously.

You have 30 days to give written notice of your injury to your employer after it happens. Yes, we mentioned this above, but it bears repeating because it’s that important. While there are rare exceptions for delayed findy of certain injuries or illnesses, don’t count on them. Get that written notice in as soon as possible.

Your employer has one day to provide or mail you the claim form once they know about your injury. One day. Not a week, not “when we get around to it.” This requirement ensures injured workers can start the claims process immediately.

You have one year to file your completed claim form from the date of injury. This is your window to formally submit your DWC-1 to your employer. A smart move? Submit it in person and get a stamped copy as proof, or send it via certified mail with return receipt requested. Either way, you’ll have documentation that you met this deadline.

The insurance company gets 90 days to investigate your claim and decide whether to accept or deny it. This investigation period is significant because if they don’t formally deny your claim within these 90 days, there’s a presumption that your injury is work-related and covered. The burden then shifts to them to prove otherwise.

What Happens After You File a Claim?

Once you’ve submitted your DWC-1 form, several things happen simultaneously. Understanding this phase helps you know what to expect and what to watch for.

Medical treatment must be authorized within one day of your employer receiving the claim form. This is one of the most worker-friendly aspects of California workers comp law. You don’t have to wait weeks or months to see a doctor—treatment authorization happens immediately.

While the insurance company investigates your claim, you can receive up to $10,000 in medical care. This ensures you’re not stuck in limbo, unable to get treatment while bureaucrats shuffle papers. You’re getting the care you need, and the bills are being paid, even before the claim is officially accepted.

That 90-day investigation period we mentioned? It creates what’s called a presumption of compensability. Essentially, if the insurance company doesn’t actively deny your claim within those 90 days, the law assumes your injury is work-related and covered. This doesn’t mean they can never challenge it, but it puts you in a much stronger position.

During your treatment, you might encounter something called Utilization Review (UR). This is where the claims administrator reviews your doctor’s treatment recommendations to make sure they’re medically necessary and appropriate. If your doctor requests a specific procedure or medication and the UR process denies it, that decision can be appealed through an Independent Medical Review (IMR), where an independent medical expert makes the final call.

Throughout this process, you’ll work with a claims administrator who manages your case for the insurance company. Keep detailed records of every phone call, every letter, every medical appointment. Save emails. Take notes during phone conversations, including the date, time, and name of who you spoke with. This documentation becomes invaluable if disputes arise later.

The claims process isn’t always smooth, but knowing these steps gives you a roadmap through what can otherwise feel like a confusing journey. And remember, you don’t have to steer it alone—experienced workers’ compensation attorneys have guided thousands of injured workers through this exact process.

When a Claim is Denied: The Appeals and Settlement Process

A denied claim can feel like a punch to the gut, especially when you’re already dealing with an injury. But here’s the truth: a denial isn’t the final word. It’s actually quite common for claims to be challenged, and the system has built-in protections to ensure you get a fair hearing.

Insurance companies deny claims for all sorts of reasons. Sometimes they dispute whether your injury really happened at work. Other times, they’ll argue there isn’t enough medical evidence linking your condition to your job. We’ve seen denials based on missed deadlines, disputed medical opinions, and even social media posts that the insurer claims contradict your injury. The company might send you to their own doctor who conveniently finds nothing wrong.

But California workers comp law gives you powerful tools to fight back. The Workers’ Compensation Appeals Board (WCAB) exists specifically to resolve these disputes. Think of it as your safety net when the insurance company says no.

Challenging a Denied Claim

When you decide to challenge a denial, you’re essentially taking your case to court—but it’s a specialized court designed specifically for workers’ compensation disputes. The process has several stages, and understanding them helps take away some of the mystery.

First, you’ll file an Application for Adjudication of Claim with the WCAB. This formal document opens your case and puts everyone on notice that you’re disputing the denial. You can find guidance on required documents through the Division of Workers’ Compensation.

Next comes the Declaration of Readiness to Proceed. This tells the judge that you’ve gathered your evidence, completed your medical treatment (or reached a point where you know what your permanent disability is), and you’re ready to move forward. You can access the Declaration of Readiness to Proceed form online.

Before any trial happens, your case will be scheduled for a Mandatory Settlement Conference (MSC). The word “mandatory” is key here—everyone has to show up and genuinely try to resolve the dispute. A workers’ compensation judge facilitates this informal meeting between you (and your attorney, if you have one), the claims administrator, and their attorney. The judge will hear both sides and often provide their opinion on the case’s strengths and weaknesses. Many cases settle at this stage because everyone gets a reality check about what might happen at trial.

If settlement talks break down, you’ll proceed to the trial process. Don’t let the word “trial” intimidate you. Workers’ comp trials are less formal than regular court trials. You’ll present your evidence—medical records, testimony from doctors, your own testimony about how the injury happened and affects your life. The insurance company will present their side. A workers’ compensation judge will hear everything and make a decision based on the evidence.

Even after a judge’s decision, you’re not out of options. If you disagree with the ruling, you can file a Petition for Reconsideration. This asks a panel of commissioners at the WCAB to review the judge’s decision for legal or factual errors.

This entire process can feel overwhelming, which is exactly why many injured workers in Nevada City, Grass Valley, and throughout Northern California reach out to experienced attorneys who know how to steer these waters.

Understanding Workers’ Comp Settlements

Here’s some good news: most workers’ compensation cases don’t drag through a full trial. The vast majority settle, often at that Mandatory Settlement Conference. But settlements aren’t one-size-fits-all. California workers comp law recognizes two main types, and understanding the difference is crucial.

| Settlement Type | Description | Key Features |

|---|---|---|

| Stipulated Findings and Award (Stips) | You and the insurance company agree on the nature and extent of your injury and the benefits you’ll receive. The judge approves this agreement and issues an award. | You continue to receive medical treatment for your injury for life if needed. Disability payments may be structured over time or paid as a lump sum. You can reopen the case later if your condition worsens. |

| Compromise and Release (C&R) | A final settlement where you receive a lump-sum payment in exchange for closing your case completely. | You give up the right to future medical treatment through workers’ comp for this injury. The case is permanently closed—you cannot reopen it later. Typically results in a larger immediate payment. |

Stipulations with Request for Award (commonly called “Stips”) keep your case technically open. This matters because if your back injury that settled three years ago suddenly gets worse, you can potentially reopen your case and receive additional benefits. You also maintain your right to medical treatment for that injury for the rest of your life. The insurance company remains responsible for covering doctor visits, medications, and procedures related to your work injury.

Compromise and Release agreements (C&R) are different animals entirely. You’re agreeing to a final, lump-sum payment in exchange for walking away from your claim forever. Once a C&R is approved by a judge, that’s it. You cannot come back later for more medical treatment or additional disability payments, even if your condition deteriorates. The trade-off is that C&R settlements often result in larger immediate payments because the insurance company values the certainty of closing the case forever.

Which type of settlement makes sense depends entirely on your situation. Are you young with a serious back injury that might need surgery down the road? A Stips agreement might protect you better. Are you older, ready to move on, and confident you won’t need future treatment? A C&R might give you more money upfront.

These decisions have life-long consequences, which is why having someone in your corner who understands California workers comp law inside and out can make all the difference between a fair settlement and one you’ll regret years later.