When Workers’ Comp Steps In: Understanding Payment for Missed Work

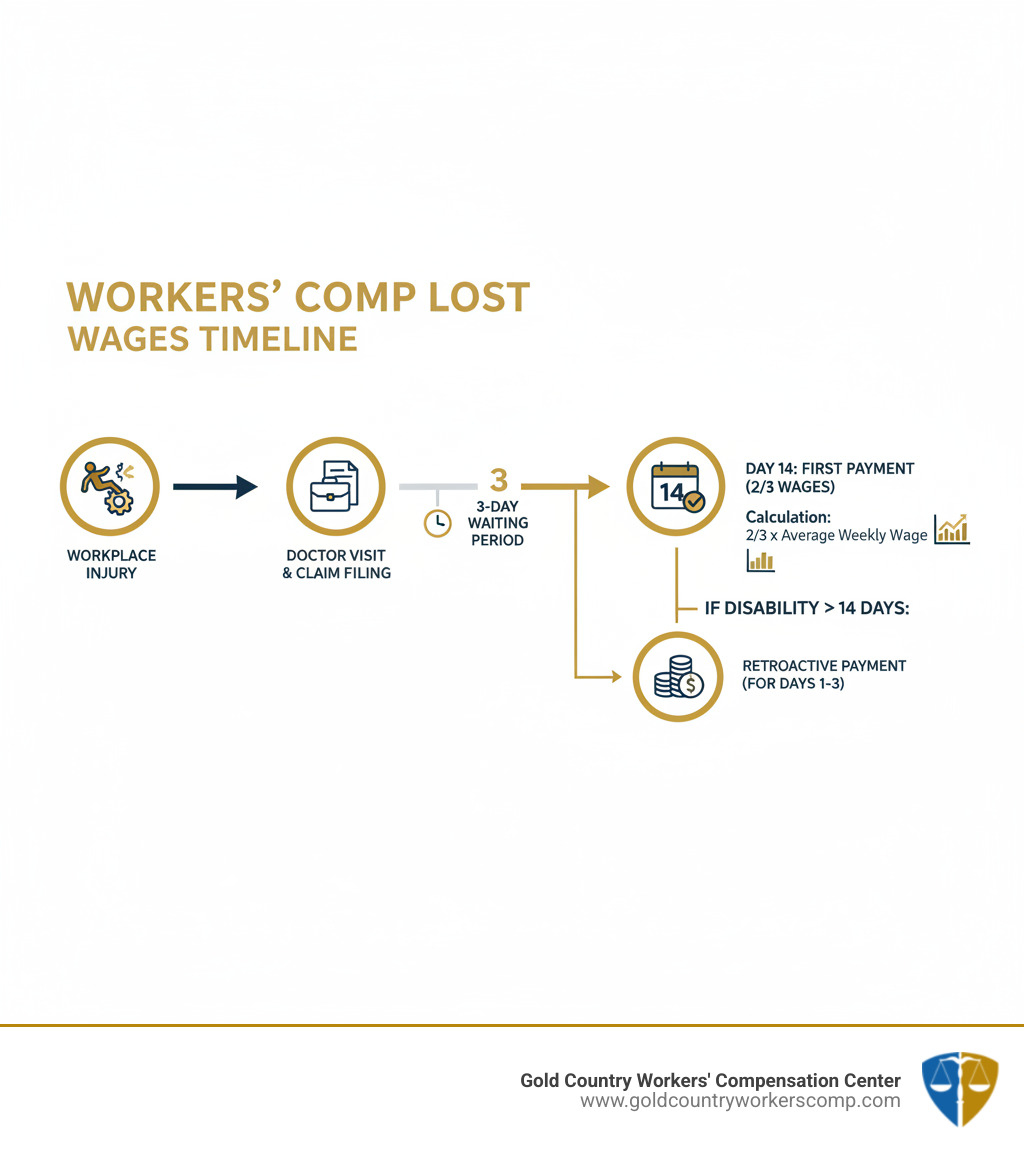

Will workers comp pay for missed days is one of the first questions injured workers ask. The short answer is yes—but only if your doctor says you can’t work and after a required waiting period.

Here’s what you need to know:

- Workers’ compensation pays for missed days if a doctor certifies you are unable to work due to your injury.

- In California, you must miss 3 days of work before benefits begin (other states have similar 3-7 day waiting periods).

- If you are unable to work for 14 days or more, benefits become retroactive, meaning you get paid for the first 3 days.

- You will receive two-thirds of your average weekly wages, not your full paycheck.

- The first check typically arrives within 14 days after your employer is aware of your injury and disability.

When you’re injured, navigating lost wage benefits—also called indemnity or disability benefits—can be overwhelming. The workers’ compensation system is designed to replace a portion of your wages while you recover, but there are rules about when payments start, how much you’ll receive, and how long they last.

This guide breaks down exactly when workers’ comp will pay for your missed days, how much you can expect, and the steps you need to take to secure your benefits.

Understanding Your Right to Lost Wage Benefits

When a workplace injury keeps you from earning a paycheck, workers’ compensation is there to help. In California, every employer must carry workers’ compensation insurance. It’s a no-fault system, meaning if you’re hurt on the job, you are entitled to benefits, regardless of who was at fault.

Workers’ comp provides two main types of support: coverage for all necessary medical care and lost wage benefits (also called temporary disability) when your injury prevents you from working. These benefits are a financial lifeline, but receiving them depends on your doctor’s assessment that you cannot perform your job duties.

The process begins when you report your injury to your employer, which you must do within 30 days. Your employer then has 24 hours to provide a DWC-1 claim form. Filing this form is the official first step to receiving compensation for missed days.

Under what circumstances will workers comp pay for missed days?

Payment for missed days hinges on your doctor’s medical determination. You are eligible for benefits in two main scenarios:

-

Total Disability: Your doctor determines you cannot work at all. This is called Temporary Total Disability (TTD). For example, a construction worker with a severe back injury who is told to stay home and recover would receive TTD benefits.

-

Partial Disability with Lost Wages: Your doctor clears you to return to work with restrictions (e.g., reduced hours, no heavy lifting). If these restrictions cause you to earn less than your pre-injury wages, you qualify for Temporary Partial Disability (TPD) benefits to supplement your income.

In both cases, your doctor’s authorization is essential. Without medical documentation supporting your time off or work restrictions, the insurance company will not pay.

What is the role of a doctor’s assessment?

Your doctor’s role is critical in determining if workers comp will pay for missed days. The primary treating physician creates the official record that supports your claim for financial benefits.

After your injury, your doctor will provide medical reports that detail:

- Your Disability Status: Whether you are temporarily totally disabled, partially disabled, or have reached Maximum Medical Improvement (MMI)—the point at which your condition has stabilized.

- Work Restrictions: Specific limitations on your activities, such as lifting weight limits or restrictions on standing. These determine what kind of work you can safely perform.

- Return-to-Work Authorization: The doctor decides when and if you can return to your job, either in a full or modified capacity.

If the insurance company disputes your doctor’s findings, they may require you to see an Independent Medical Examiner (IME) for a second opinion. Clear and consistent documentation from your treating physician is your strongest tool for proving your need for time off and securing your benefits.

Will Workers Comp Pay for Missed Days? The Waiting Period Explained

Understanding the waiting period is crucial when asking, “will workers comp pay for missed days?” While the system is designed for timely support, there’s a short initial period where wage replacement benefits don’t apply.

How long is the waiting period before benefits are paid?

In California, there is a three-day waiting period before lost wage benefits begin. This means you will not be paid for the first three calendar days you are unable to work due to your injury. The clock starts on the first full day you miss work.

This waiting period is a standard feature in most states, though the duration varies. Once your claim is accepted, the first payment for eligible days should arrive within 14 days of your employer being notified of your injury and disability.

What if my disability lasts longer than 14 days?

If your inability to work extends beyond 14 calendar days, the waiting period becomes retroactive. This means you will be paid for the initial three days that were unpaid.

For example, if you are out of work for 10 days, you will be paid for 7 of them. However, if you are out for 15 days, you will be paid for all 15. This rule ensures that workers with more significant injuries receive more comprehensive compensation for their lost time from day one.

How Your Lost Wage Payments Are Calculated

Once you know workers comp will pay for missed days, the next question is, “How much will I receive?” Workers’ comp is designed to replace a portion of your income, not your full paycheck.

How is the amount of lost wage benefits determined?

In California, lost wage benefits are calculated as two-thirds of your Average Weekly Wage (AWW), which is based on your gross earnings (before taxes) in the 52 weeks prior to your injury. Your AWW includes all forms of income, such as regular wages, overtime, and earnings from other jobs (concurrent employment).

While two-thirds may seem low, these benefits are tax-free, so the amount you receive is often close to your usual take-home pay.

California also sets annual limits. For injuries occurring in 2025, the maximum Temporary Disability rate is $1,686.74 per week. Even if two-thirds of your AWW is higher, your benefit will be capped at this amount. There is also a minimum benefit to support lower-wage workers. These rates are adjusted annually, so check the current figures.

What is the difference between temporary total and temporary partial disability?

Lost wage benefits fall into two categories based on your ability to work:

-

Temporary Total Disability (TTD): You receive TTD benefits when your doctor determines you are completely unable to work. Payments are two-thirds of your AWW (up to the state maximum) and continue until you can return to work or reach Maximum Medical Improvement.

-

Temporary Partial Disability (TPD): TPD benefits apply when you can return to work but with limitations that result in reduced earnings (e.g., fewer hours or a lower-paying modified role). TPD pays two-thirds of the difference between your pre-injury and current earnings. For example, if you lost $400 in weekly wages, your TPD benefit would be approximately $267 per week.

TPD is designed to support your transition back to the workforce without financially penalizing you for working within your doctor’s restrictions.

Navigating Special Circumstances and Potential Roadblocks

The workers’ compensation process isn’t always simple. Certain situations can affect whether workers comp will pay for missed days, and knowing how to handle them is key.

Can I receive benefits if I am offered light-duty work?

Yes. If your doctor releases you to modified or “light-duty” work and your employer offers a position that accommodates your restrictions, you may still be eligible for benefits. If the new role pays less than your pre-injury job (due to fewer hours or lower pay), you can receive Temporary Partial Disability (TPD) benefits. These payments cover two-thirds of the wage difference.

The crucial element is that the job offer must align with your doctor’s approved restrictions. Clear communication between you, your doctor, and your employer is essential.

What are the implications of refusing a modified job offer?

Refusing a suitable modified job offer can have serious consequences. If your employer offers a position that fits within your doctor’s restrictions and you decline it without a valid reason, your lost wage benefits will likely be terminated. The insurance company may argue you are voluntarily choosing not to earn available income.

However, there can be valid reasons to refuse, such as if the job does not truly meet your medical restrictions or is otherwise unsuitable. If you are unsure about a light-duty offer, it is critical to seek legal advice to protect your benefits.

Are there situations where will workers comp pay for missed days is not an option?

Yes, there are circumstances where you may not be eligible for lost wage benefits. These include:

- Injury is Not Work-Related: The injury must arise out of and in the course of your employment.

- Waiting Period Not Met: If you are disabled for three days or less, you will not receive wage benefits for that time.

- Refusing a Suitable Job Offer: As discussed above, turning down appropriate modified work can end your benefits.

- Claim Denial: If the insurer denies your claim, benefits will not be paid unless you successfully appeal the decision. Denials can happen for many reasons, including late reporting or disputes over the cause of the injury.

- Fraud: Intentionally misrepresenting your injury or ability to work will result in a denial and potential legal penalties.

- Pre-existing Conditions: Workers’ comp does not cover pre-existing conditions unless your work duties significantly aggravated or worsened the condition. Proving this requires strong medical evidence.

The Long-Term Outlook: From Temporary to Permanent Benefits

When you’re first injured, your focus is on immediate recovery. But for some, injuries have lasting effects, and the workers’ compensation system shifts from temporary support to addressing permanent impairments.

How long can I receive temporary lost wage benefits?

In California, you can generally receive Temporary Disability benefits for up to 104 weeks (two years) within a five-year period from your injury date. For certain severe injuries, such as severe burns or chronic lung disease, this limit extends to 240 weeks.

Temporary benefits end when your doctor clears you to return to your usual job or you reach Maximum Medical Improvement (MMI). MMI means your condition has stabilized and is not expected to improve further with treatment, even if you still have limitations.

What are permanent disability benefits?

If your injury results in a permanent impairment after you reach MMI, you may qualify for Permanent Disability (PD) benefits. Unlike temporary benefits that replace wages, PD benefits compensate you for the permanent loss of function and its impact on your future earning capacity.

Your level of impairment is assigned a percentage rating by a doctor, which determines the value of your PD benefits. Unfortunately, the maximum weekly PD payment rate has been capped at $290 per week since 2014 and has not been adjusted for inflation. These benefits can be paid in weekly installments or as a lump-sum settlement, which may close out your rights to future medical care.

In rare cases of catastrophic injury resulting in permanent total disability, you may be entitled to lifetime benefits. For more details, the California Department of Industrial Relations offers information on Permanent Disability (PD) benefits.

How do workers’ comp benefits differ from Social Security?

It’s common to confuse workers’ compensation with Social Security Disability, but they are separate programs:

-

Workers’ Compensation: A state-mandated insurance program paid by your employer. It covers medical care and lost wages specifically for work-related injuries and illnesses. Benefits can begin after a short waiting period.

-

Social Security Disability (SSD): A federal program funded by your payroll taxes. It provides income to individuals with a severe, long-term disability (expected to last at least 12 months or result in death) that prevents them from performing any substantial work, regardless of whether the disability is work-related. The application process is often lengthy.

You may be eligible for both programs, but receiving workers’ comp can reduce your Social Security benefit amount. Navigating these systems can be complex, and legal guidance is often necessary to secure all the benefits you are entitled to. You can learn more from the Social Security Administration.

Frequently Asked Questions about Lost Wages

Many injured workers share the same questions and concerns about lost wages. Here are answers to some of the most common ones we hear.

What happens if my employer continues to pay my wages while I’m out?

If your employer pays your full salary while you recover—through sick leave, vacation time, or a salary continuation plan—you will not receive separate lost wage benefits from the workers’ comp insurer for that same period. You cannot be paid twice for the same time off. However, your employer can often seek reimbursement from the insurer for the wages they paid you. It’s important to keep clear records to avoid any overpayment issues.

What happens if my workers’ compensation claim for lost wages is denied?

A denial is not the final word. The insurer must provide a written explanation for the denial, which could be due to a dispute over whether the injury is work-related, a lack of medical evidence, or a procedural error. The insurer has up to 90 days to investigate and potentially deny a claim.

You must act quickly to appeal a denial. In California, this involves filing an Application for Adjudication of Claim. This is a critical moment where an experienced attorney can make a significant difference. At Gold Country Workers’ Compensation Center, we review denial letters, gather necessary evidence, and represent our clients before a judge to fight for the benefits they deserve. Our early intervention approach, with no initial consultation fee, is designed to build the strongest possible case from the start.

What benefits are available for dependents if a worker dies?

When a worker dies from a work-related injury, California’s workers’ compensation system provides death benefits to support their dependents. These benefits include:

- Burial Expenses: A payment up to a statutory maximum to cover funeral costs.

- Weekly Payments: Eligible dependents (typically a surviving spouse and minor children) receive weekly payments, usually calculated as two-thirds of the deceased worker’s average weekly wage.

The duration of these payments depends on the dependent. Children generally receive benefits until age 18. A surviving spouse may receive benefits for life or until they remarry, at which point they typically receive a final lump-sum payment. Calculating these benefits is complex, and compassionate legal guidance can ensure a family receives the full support they are entitled to during a difficult time.

Conclusion

You now have a clearer understanding of when and how workers comp will pay for missed days in California. While the system can feel complex, knowing your rights is the first step toward securing the financial support you need.

The key takeaways are that your doctor’s medical opinion is paramount, a short waiting period applies but is paid retroactively for longer disabilities, and benefits are calculated as two-thirds of your average weekly wage, tax-free. Whether you are completely out of work or on light duty with reduced pay, the system is designed to bridge the financial gap.

If your claim is denied or you face roadblocks, you have the right to appeal. The journey from a temporary injury to a permanent one involves different types of benefits, and navigating each stage requires knowledge and persistence.

At Gold Country Workers’ Compensation Center, our team, led by Kim LaValley and Kyle Adamson, has nearly 50 years of combined experience helping injured workers in Grass Valley, Nevada City, Roseville, and the greater Sacramento area. We are committed to early intervention and personalized attention.

If you are struggling with your claim or simply want to ensure you’re receiving all your benefits, we are here to help. We don’t charge for initial consultations because you deserve to understand your options without financial risk. Don’t let confusion or intimidation prevent you from getting the benefits you’ve earned. Reach out to us for a free consultation to understand your full range of workers’ comp benefits. Your focus should be on healing—let us handle the legal complexities.