Understanding Your Workers’ Comp Wage Replacement Benefits

When a work-related injury or illness leaves you unable to earn a paycheck, the financial stress can be overwhelming. This is where workers comp wage replacement comes in. These payments, also known as indemnity benefits, are a crucial part of your workers’ compensation package, designed to provide a financial bridge during your recovery.

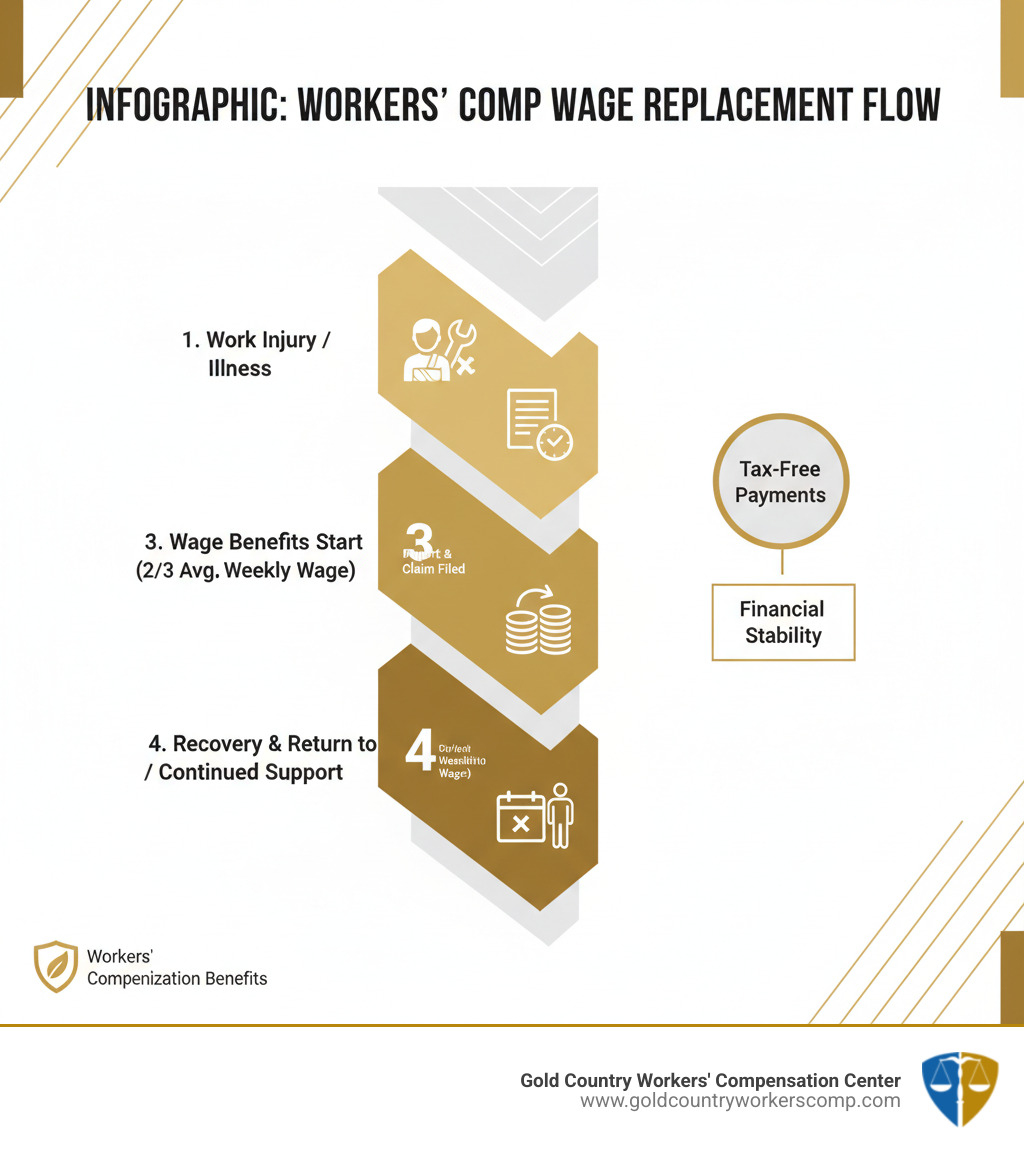

Essentially, wage replacement benefits partially substitute your lost income. They typically pay a percentage (often two-thirds) of your average weekly wage, up to a maximum amount set by the state. A key advantage is that these benefits are generally tax-free, helping them stretch further. The purpose is to offer financial stability, allowing you to focus on healing without the constant worry of how to pay your bills.

Understanding how these benefits work can ease a lot of stress and empower you to steer your recovery with more confidence.

What Are Workers’ Comp Wage Replacement Benefits?

Workers’ compensation is a social insurance program providing a safety net for employees and employers. As a “no-fault” system, it ensures you receive medical care and financial support for a job-related injury without needing to prove who was to blame. The focus is simply on whether the injury is work-related.

Workers’ comp has two main components: medical benefits cover treatment costs like doctor visits and physical therapy, while workers comp wage replacement (or indemnity benefits) helps replace your missing paycheck. While both are vital, wage replacement is what keeps your household running when you can’t work.

To qualify, you must be an employee whose injury or illness is work-related. This includes sudden injuries, like a fall, and conditions that develop over time, like carpal tunnel syndrome. In California, any employer with at least one employee must have workers’ compensation insurance. Reporting your injury to your employer promptly is the crucial first step to starting the claim process.

The Primary Purpose: Financial Support During Recovery

The financial stress of a work injury can be as debilitating as the physical pain. Workers comp wage replacement exists to mitigate this financial burden by helping you cover essential living expenses like rent, utilities, and groceries. A significant advantage is that these benefits are typically non-taxable, meaning the amount you receive is close to your usual take-home pay.

This financial support provides peace of mind. When you aren’t worried about making ends meet, you can focus your energy on what matters most: your recovery.

Who Is Eligible for Wage Replacement?

In California, eligibility for workers comp wage replacement is broad. If you are an employee (full-time, part-time, temporary, or seasonal) and suffer a work-related injury or illness, you are generally covered. This applies to both traumatic injuries (sudden accidents) and repetitive stress injuries that develop over time. California law even protects workers regardless of their immigration status.

However, some common exemptions exist. Federal employees are covered by a separate federal system (FECA). Other exempt groups may include certain agricultural workers, some domestic workers, business owners with no employees, and specific volunteers. If you’re unsure about your eligibility, especially regarding your employment classification, it’s wise to seek professional guidance. The team at Gold Country Workers’ Compensation Center offers consultations at no initial cost to help clarify these situations.

How Are Wage Replacement Benefits Calculated?

Calculating your workers comp wage replacement benefits involves a few key factors. The system is designed to replace a portion of your lost income, not your entire paycheck. The general formula is two-thirds of your average weekly wage. However, this amount is subject to state-mandated maximum and minimum weekly benefit amounts.

These limits are adjusted annually in California to reflect economic changes, influenced by the Statewide Average Weekly Wage (SAWW). This ensures benefits keep some pace with the cost of living. For the most current figures and detailed information, the California Division of Workers’ Compensation (DWC) website is the official resource: https://www.dir.ca.gov/dwc/workerscompensationbenefits.htm.

Determining Your Average Weekly Wage (AWW)

The foundation of your benefit calculation is your Average Weekly Wage (AWW). This figure represents your earnings before your injury. To determine your AWW, the insurance company typically reviews your gross earnings (pre-tax pay) from the 52 weeks prior to your injury. This includes not just your regular salary or hourly pay but also overtime, bonuses, and commissions. The goal is to capture a fair representation of your typical income. Adjustments can be made for irregular employment or if you worked for less than a year.

State-Specific Rates and Maximums

The “two-thirds rule” is a general guideline, but specific rates and maximums for workers comp wage replacement vary by state. In California, the rates are adjusted annually.

For example, as of January 1, 2023, the minimum Temporary Total Disability (TTD) rate in California was $242.86 per week, and the maximum TTD rate was $1,619.15 per week. It’s crucial to check the official California DWC website for the latest benefit tables applicable to your date of injury.

To illustrate how states differ, here is a comparison of approximate TTD benefits:

| State | General Benefit Rate | 2023/2024 Maximum Weekly Benefit (approx.) |

|---|---|---|

| California | 2/3 of AWW | $1,619.15 (as of 1/1/2023) |

| North Carolina | 2/3 of AWW | $1,184 (2022) / $1,380 (2025 proj.) |

| New York | 2/3 of AWW (adjusted by disability) | Varies annually, based on NYSAWW |

This table provides approximate figures for comparison. Always confirm the latest rates for your specific injury date and state.

The Four Main Types of Disability Benefits Explained

As you recover from a work injury, you may move through different phases of disability. A crucial milestone is reaching Maximum Medical Improvement (MMI), the point where your condition is considered stable. This often determines whether your disability is temporary or permanent and which of the four main types of workers comp wage replacement you may receive.

Temporary Disability Benefits (TTD & TPD)

These benefits provide wage replacement while you are actively recovering.

- Temporary Total Disability (TTD): If your doctor determines you cannot work at all for a temporary period, TTD pays two-thirds of your average weekly wage. These payments continue until you can return to work or reach MMI.

- Temporary Partial Disability (TPD): If you can return to work in a limited capacity (e.g., light duty) and earn less than before, TPD helps bridge the gap. It typically pays two-thirds of the difference between your pre-injury and current wages.

Permanent Disability Benefits (PPD & PTD)

If your injury results in a lasting impairment after reaching MMI, you may be eligible for permanent disability benefits.

- Permanent Partial Disability (PPD): This applies when you have a permanent impairment but can still work in some capacity. California uses a comprehensive impairment rating to calculate PPD benefits, compensating you for the long-term loss of function.

- Permanent Total Disability (PTD): For the most severe cases where an injury permanently prevents you from any gainful employment, PTD benefits are paid. These benefits, which can last for life, are reserved for catastrophic injuries like the loss of limbs or severe brain injuries.

The Role of an Impairment Rating

An impairment rating is a medical assessment that quantifies the extent of your permanent loss of function after you reach Maximum Medical Improvement (MMI). A doctor evaluates your condition, often using the American Medical Association (AMA)’s Guides to the Evaluation of Permanent Impairment, and assigns a percentage of impairment.

This percentage is a key factor in calculating your permanent disability benefits. In California, this rating is called a Whole Person Impairment (WPI) score, which is then adjusted for your occupation and age to determine your final disability rating. You can learn more about this on the DWC workers’ compensation benefits page. If you disagree with your rating, you have the right to challenge it, often by requesting an Independent Medical Examination (IME).

Navigating the Workers’ Comp Wage Replacement Process

Understanding the process for receiving workers comp wage replacement can make a difficult time more manageable. The journey follows several key steps: reporting the injury, seeking medical care, filing a claim, and, if approved, receiving benefits.

The typical process is as follows:

- Report the Incident: Notify your employer immediately after the injury occurs or you realize it’s work-related.

- Seek Medical Treatment: A doctor’s evaluation is crucial for documenting your injury and your inability to work.

- File a Claim: Complete and submit the necessary forms provided by your employer.

- Insurer Investigation: The insurance carrier will review your claim to verify the details.

- Claim Approval or Denial: If approved, your benefits will be calculated and disbursed. If denied, you have the right to appeal.

The Waiting Period Before Benefits Begin

Most workers’ compensation systems have a waiting period before wage replacement benefits begin. In California, you typically won’t be paid for the first three days you are unable to work. However, there are important exceptions:

- The waiting period is waived if you are hospitalized overnight due to the injury.

- If your disability lasts for more than 14 days, you will be paid retroactively for those first three days.

Once a claim is accepted, you should receive your first payment within 14 days of your employer learning about your disability. Other states have different rules; for example, North Carolina has a 7-day waiting period.

What to Do if Your Workers Comp Wage Replacement is Denied or Disputed

A denied claim or a dispute over your benefit amount can be frustrating, but you have the right to challenge the decision. If your claim is denied in California, you can file an appeal with the Workers’ Compensation Appeals Board (WCAB), the state body that resolves such disputes.

If you disagree with the doctor’s impairment rating, which directly affects your permanent disability benefits, you can request an Independent Medical Examination (IME) for a second opinion. Navigating appeals and disputes can be complex, and seeking legal assistance is often a wise step to protect your rights.

Understanding Settlements: Clincher Agreements

In California, a workers’ compensation claim can be resolved through a settlement, known as a “Compromise and Release” (C&R) or “Stipulations with Request for Award” (Stips). In exchange for a lump-sum payment, you agree to permanently close your claim and waive all future rights to medical care and wage replacement for that injury.

This is a final, binding decision with significant long-term consequences. It is critical to consult with a qualified workers’ compensation attorney before signing any settlement agreement to ensure the offer is fair and your rights are protected.

Additional Considerations and Related Benefits

Beyond direct disability payments, the workers comp wage replacement landscape includes other forms of support that can aid in your recovery and return to work. Understanding how these benefits interact is key to maximizing your support.

Can You Receive Other Benefits Simultaneously?

Receiving workers comp wage replacement alongside other income or benefits can be complex. Generally, you cannot be paid twice for the same period of lost work.

- Employer Pay: If your employer continues to pay your full salary, you typically won’t also receive workers’ comp wage replacement.

- STD/LTD Insurance: Private Short-Term or Long-Term Disability policies usually do not pay out at the same time as workers’ comp for a work-related injury. Workers’ comp is the primary payer, and other benefits may be reduced or offset.

- Social Security Disability (SSDI): You may qualify for federal SSDI benefits for a long-term disability. However, the Social Security Administration may reduce your SSDI payments if you are also receiving workers’ comp. This “offset” ensures your combined benefits do not exceed a certain percentage of your pre-disability earnings.

Other Financial Support: Vocational Rehab and Travel Expenses

If a permanent injury prevents you from returning to your old job, help is available. In California, you may be eligible for a Supplemental Job Displacement Benefit (SJDB). This is a voucher worth up to $6,000 to be used for education, vocational retraining, or other skill-building services to help you find a new career.

Additionally, you are entitled to reimbursement for reasonable travel expenses for medical treatment related to your work injury. This includes mileage (projected to be around $0.70 per mile in California for 2025), parking, and tolls. Keep detailed records and receipts of all treatment-related travel to ensure you are fully reimbursed. You can find current rates on the DWC workers’ compensation benefits page.

What Are Workers Comp Wage Replacement Death Benefits?

If a work-related injury or illness results in a worker’s death, workers’ compensation provides death benefits to support the surviving family. These benefits offer financial stability during an incredibly difficult time.

In California, death benefits are paid to a surviving spouse, children, or other financial dependents. The total benefit amount depends on the number of dependents, ranging from $250,000 for one dependent to $320,000 for three or more. Payments are typically made weekly at the temporary disability rate. Minor children will continue to receive payments until they turn 18. Additionally, workers’ compensation covers reasonable burial expenses up to $10,000 for injuries after January 1, 2013. Filing these claims involves strict deadlines, so families should seek guidance to secure the support they are entitled to.

Conclusion

We’ve explored the complex world of workers comp wage replacement, from how benefits are calculated to the differences between temporary and permanent disability. It’s clear that while these benefits are a critical financial lifeline, the system itself is intricate. The rules and rates can vary depending on your location in California and the date of your injury.

When you’re facing a work injury, understanding your rights and the benefits available to you is paramount. It empowers you to make informed decisions and focus on your recovery without the added weight of financial stress.

Navigating this system alone can be daunting, but you don’t have to. The specialists at Gold Country Workers’ Compensation Center are here to help. Led by attorneys Kim LaValley and Kyle Adamson, our team offers nearly 50 years of combined experience. We are dedicated to ensuring you receive every benefit you deserve. We believe in getting involved early and offer a no initial consultation fee to provide accessible legal help for injured workers in Roseville, Nevada City, and throughout California. Our goal is to help you achieve a positive outcome and get back on your feet.

For more detailed information on your rights, we encourage you to explore our comprehensive guide on understanding workers’ comp benefits.