Understanding the SSDI Claim Process: Your First Step Toward Financial Security

The SSDI claim process can feel overwhelming when you’re already dealing with a disability that prevents you from working. The Social Security Administration’s (SSA) strict rules and long timelines catch many applicants off guard. This guide breaks down each stage to help you strengthen your claim.

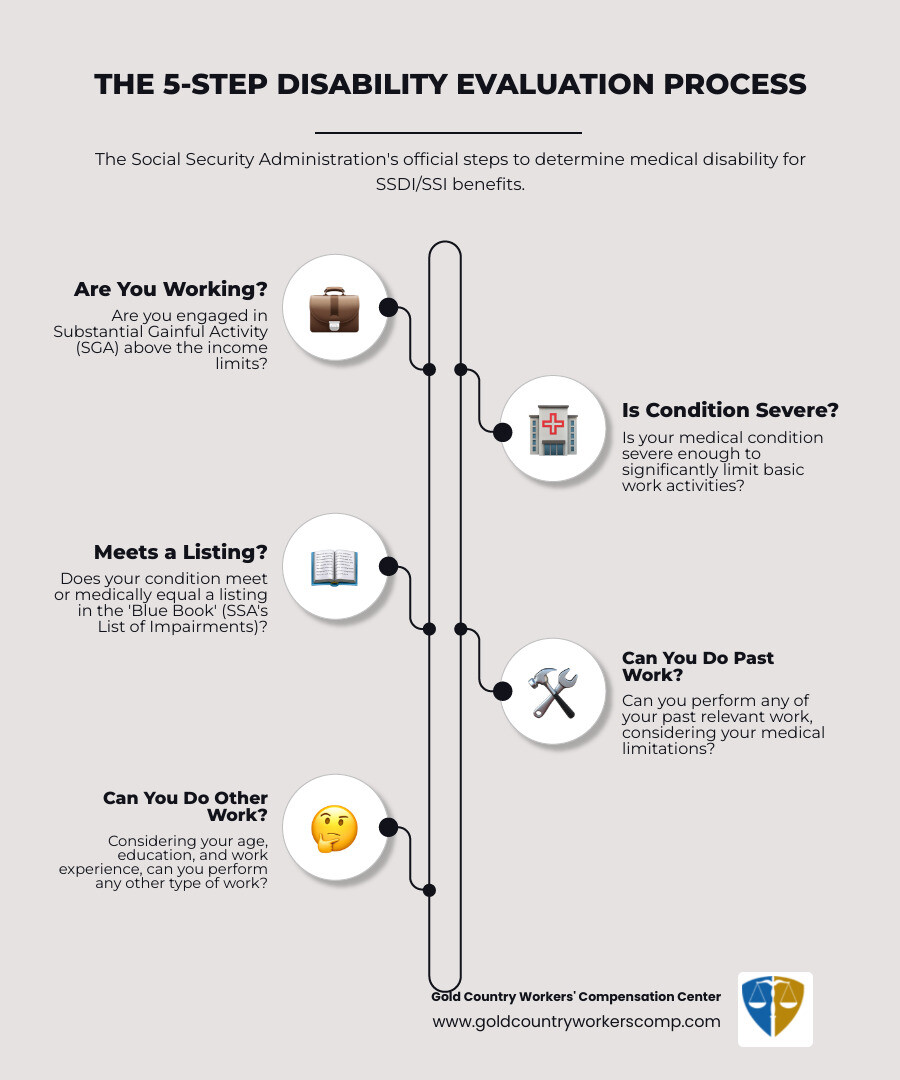

The process involves five key steps:

- Determine eligibility: You need enough work credits and a qualifying medical condition.

- Gather documents: This includes medical records, work history, and tax returns.

- Submit your application: You can apply online, by phone, or in person.

- Wait for a determination: A state agency reviews your medical evidence, which takes 3-5 months.

- Appeal if denied: About 62% of initial applications are denied, but you have the right to appeal.

From start to finish, an initial application typically takes 9 to 12 months. If you appeal, the timeline can extend to 1-2 years or more. However, some severe conditions on the Compassionate Allowances List may be approved in under 30 days.

Whether you’re applying for the first time or appealing a denial, you’ll learn what to expect and how to steer the system.

Are You Eligible? SSDI vs. SSI Explained

Before starting the SSDI claim process, you must know which program fits your situation. The Social Security Administration (SSA) offers two disability programs: Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). While both use the same medical standards, their financial requirements are very different. You may even qualify for both.

| Criteria | Social Security Disability Insurance (SSDI) | Supplemental Security Income (SSI) |

|---|---|---|

| Funding Source | FICA taxes paid through your wages | General tax revenues (not Social Security taxes) |

| Eligibility | Based on work history and payment of Social Security taxes (work credits) | Based on financial need (limited income and resources) |

| Work History | Required (must have sufficient work credits) | Not required (can qualify with no work history) |

| Medical Criteria | Must meet SSA’s definition of disability | Must meet SSA’s definition of disability |

| Income Limit | No income limit (beyond Substantial Gainful Activity) | Strict income limits apply |

| Resource Limit | No resource limit | Strict resource limits apply (e.g., less than $2,000 for an individual) |

| Medicare/Medicaid | Typically eligible for Medicare after a 24-month waiting period | Typically eligible for Medicaid immediately |

| Family Benefits | May include benefits for eligible spouses and children | No additional benefits for family members |

SSDI: Insurance for Workers

SSDI is an insurance program funded by the FICA taxes you’ve paid from your paychecks. Eligibility depends on your work history, measured in work credits. Most people need 40 credits, with 20 earned in the 10 years before their disability began. Younger workers may qualify with fewer credits. The SSA uses a recent work test and duration of work test to confirm you’ve worked long and recently enough.

Even with enough credits, you cannot earn more than the Substantial Gainful Activity (SGA) limit, an amount that changes annually. Earning above the SGA level generally disqualifies you from benefits. For more details, see the SSA’s Disability Benefits publication.

SSI: A Needs-Based Program

Supplemental Security Income is a safety net program for those with limited financial means, regardless of work history. It’s funded by general tax revenues. To qualify, you must be disabled, blind, or over 65 and meet strict income and resource limits. For 2023, an individual cannot have more than $2,000 in countable resources. Children with disabilities can also qualify for SSI based on their family’s income and resources. Learn more about SSI eligibility requirements for children on the SSA website. A key benefit of SSI is immediate eligibility for Medicaid.

The Medical Definition of Disability

Both SSDI and SSI use the same strict SSA definition of disability. A doctor’s note is not enough. Your medical condition must prevent you from performing Substantial Gainful Activity. This means you cannot do your past work or adjust to other types of work. Additionally, your condition must be expected to last at least 12 months or result in death. The SSA does not recognize partial or short-term disability.

If your condition matches a listing in the SSA’s Blue Book, you may be approved automatically. If not, the SSA will assess your limitations, age, education, and work experience to determine if you can perform any work. This is why detailed medical evidence is the cornerstone of the SSDI claim process.

How to Apply: A Step-by-Step Guide

Starting your disability application can be daunting, but breaking it into manageable steps makes it easier. Proper preparation is key to a smoother process.

Gathering Your Documents

Organizing your documents beforehand can prevent significant delays. The SSA provides an Adult Disability Starter Kit with a full checklist. Key items include:

- Personal Information: Social Security number, birth certificate, and proof of citizenship or lawful alien status. Military veterans should include their DD-214.

- Employment History: W-2s or self-employment tax returns for the last year, and a summary of jobs held in the last 15 years (titles, duties, dates).

- Medical Evidence: This is the most critical part. Compile names, addresses, and phone numbers for all doctors, clinics, and hospitals. List all medications, dosages, and prescribing doctors. Include dates of treatment, procedures, and hospitalizations. Gather any medical records, test results, and notes you have.

- Other Information: Documentation of any workers’ compensation or other public disability benefits, and your bank account details for direct deposit.

Submitting Your Application

You have three options for submitting your application:

- Online: The fastest method is to apply for Social Security benefits online at any time. You can save your progress and use the SSA’s tool to check your eligibility first.

- By Phone: Call the SSA at 1-800-772-1213 (TTY 1-800-325-0778) to schedule an appointment to apply over the phone.

- In Person: Visit a local office for face-to-face assistance. In California, we have offices in Roseville and Nevada City. You can find an SSA regional office near you.

No matter how you apply, you will need to sign a medical release form (SSA-827) allowing the SSA to request your records. Accuracy and thoroughness at this stage are vital for a smooth SSDI claim process.

Conditions That May Expedite Your Claim

While most claims take months, certain severe conditions can be processed much faster. The Compassionate Allowances (CAL) list includes 266 conditions that often qualify for approval in under 30 days. The Quick Disability Determination (QDD) program also uses a computer model to fast-track claims with a high likelihood of approval. Claims involving a terminal illness or from military veterans also receive priority processing. If you believe your condition qualifies, highlight this in your application with clear medical documentation.

The Disability Determination and SSDI Claim Process

After you apply, your claim enters the disability determination phase. This is where the Social Security Administration (SSA) and state agencies evaluate your medical condition against their strict criteria.

The Initial Review and Determination

First, your local SSA office verifies your non-medical eligibility (age, work history, etc.). Then, your file goes to a state agency called Disability Determination Services (DDS) for the medical review. A disability examiner and a medical consultant will gather your medical records. If the evidence is insufficient, they may ask you to attend a consultative examination (CE) with an SSA-approved doctor at no cost to you.

This initial review process typically takes 3 to 5 months. Once DDS makes a decision, your case returns to the SSA. If approved, they will calculate your benefits. If denied, your file is kept in case you appeal. You can learn more on the SSA’s Disability Determination Process page.

What to Do If Your Claim is Denied

Receiving a denial letter is disheartening, but it is not the end of the road. Approximately 62% of initial applications are denied, often due to insufficient evidence. This does not mean your claim is invalid. A denial is an opportunity to strengthen your case and proceed with an appeal.

Your denial letter will explain the decision and your right to appeal. You have only 60 days from the date you receive the notice to file an appeal. Missing this deadline can force you to start the entire SSDI claim process over, potentially losing valuable back pay. Many applicants who are initially denied win their cases on appeal, so it is crucial not to give up.

The Four Levels of the Appeals Process

The appeals process offers four chances to challenge a denial. Each level has a strict 60-day deadline to file.

- Reconsideration: A new team at DDS reviews your original file plus any new evidence you provide. Most reconsiderations are also denied, but it is a required step. You can request reconsideration using Form SSA-561.

- Hearing by an Administrative Law Judge (ALJ): This is your best chance for approval. You appear before a judge to testify about your condition and how it limits you. You can have a representative, like an attorney, present your case and question expert witnesses. The wait for a hearing can be long, sometimes up to a year or more.

- Review by the Appeals Council: If the ALJ denies your claim, you can ask the Appeals Council to review the decision for legal or procedural errors. The council can approve your claim, send it back to the ALJ, or deny the review. This stage can take 1 to 2 years.

- Federal Court Review: The final step is to file a lawsuit in federal district court. This is a complex legal process that typically requires an attorney to argue that the SSA’s decision was not supported by law or evidence.

Meeting the 60-day deadlines at each stage is critical. If you anticipate missing a deadline, contact the SSA immediately.

After the Decision: Managing Your Benefits

An approval letter is a huge relief after navigating the challenging SSDI claim process. Now, it’s time to understand how your payments, healthcare, and potential return to work are managed.

Receiving Your SSDI Payments

Your approval letter will state your monthly benefit amount and when payments begin. SSDI has a mandatory 5-month waiting period, meaning your first payment is for the sixth full month after your disability began. The only exception is for individuals with ALS, who have no waiting period.

Your benefit amount is based on your lifetime average earnings covered by Social Security. Depending on how long your application took, you may also receive a lump-sum payment for back pay, covering the months between the end of your waiting period and your approval. Payments are made via direct deposit.

Be aware that receiving other benefits, like workers’ compensation or public disability benefits, can reduce your SSDI payment. If your combined benefits exceed 80% of your pre-disability average earnings, the SSA will apply an offset. Always report other benefits to the SSA to avoid overpayments.

Medicare Coverage for Disability Recipients

After you receive SSDI benefits for 24 months, you will be automatically enrolled in Medicare. Combined with the 5-month SSDI waiting period, this means Medicare coverage typically starts 29 months after your disability began. Individuals with ALS are eligible for Medicare in their first month of SSDI benefits.

- Medicare Part A (Hospital Insurance) covers inpatient care and is usually premium-free.

- Medicare Part B (Medical Insurance) covers doctor visits and outpatient care and requires a monthly premium, often deducted from your SSDI check.

Once enrolled, you can explore other options like private Medicare Advantage Plans (Part C) or Medicare Part D prescription coverage. Programs are available to help with Medicare costs if you have limited income.

Can You Work While Receiving Benefits?

Yes, the SSA has work incentives that allow you to test your ability to work without immediately losing benefits.

The Trial Work Period (TWP) lets you work for up to 9 months (not necessarily consecutive) while receiving full SSDI benefits, no matter how much you earn. After the TWP, you enter a 36-month period where you can still get benefits for any month your earnings are below the Substantial Gainful Activity (SGA) limit.

The Ticket to Work program also offers free employment support, including vocational rehabilitation and job training. It is critical to report all earnings to the SSA promptly to avoid overpayments and penalties. These programs provide a safety net, allowing you to explore returning to work without risking your financial security.

Frequently Asked Questions about the SSDI Claim Process

Navigating the SSDI claim process raises many questions. Here are concise answers to some of the most common ones.

How long does the entire SSDI claim process take?

An initial application typically takes 9 to 12 months for a decision. If your claim is denied and you appeal, the process can extend significantly. Reconsideration adds several months, a hearing before a judge can take over a year to schedule, and further appeals can take 1 to 2 years or more. However, claims for certain severe conditions on the Compassionate Allowances List can be approved in under 30 days.

Do I need a lawyer to apply for SSDI?

While you are not required to hire a lawyer for your initial application, legal representation is highly recommended, especially for appeals. An experienced disability attorney understands the SSA’s complex rules and can ensure your case is presented effectively. They can gather the right medical evidence, prepare you for hearings, and cross-examine experts. Since most disability attorneys work on a contingency fee basis, you pay nothing unless you win your case. This can significantly improve your chances of success and reduce the stress of the process.

How do other payments like workers’ compensation affect my SSDI benefits?

Your SSDI benefits may be reduced if you also receive workers’ compensation or other public disability benefits (PDB). This is called a benefit offset. The SSA limits your total combined benefits to 80% of your average pre-disability earnings. If your total payments exceed this limit, your SSDI benefit will be lowered accordingly. This offset does not typically apply to private disability insurance or VA benefits. It is crucial to report all other benefits to the SSA to prevent overpayments that you would have to pay back.

Get Help Navigating Your Disability Claim

The SSDI claim process is complex, and with a 62% initial denial rate, navigating it alone can be overwhelming. You don’t have to.

At Gold Country Workers’ Comp, we’ve spent nearly 50 years helping people in Roseville, Nevada City, and throughout Northern California win their disability cases. Kim LaValley and Kyle Adamson are dedicated to securing positive outcomes for our clients.

We specialize in both Social Security Disability and Workers’ Compensation claims, expertly handling the complex overlap between them. Our unique approach includes early intervention and a no initial consultation fee, so you can get experienced legal help without financial risk.

Whether you’re starting your application, appealing a denial, or stuck in the middle, we can help. We’ll build a strong case, manage deadlines, and represent you at hearings where skilled advocacy is critical. If your injury is work-related, we can also help you learn if you qualify for permanent stationary status.

Your financial future is too important to leave to chance. Contact us today for a free consultation and let our experience work for you.